Beer giant Anheuser-Busch InBev entered the sustainable finance market with to bang today, signing the largest-ever Sustainability Linked Loan Revolving Credit Facility (SLL RCF). The new $10 billion facility, which replaces the company’s existing credit facility, is also the first to be issued among publicly listed alcohol beverage companies.

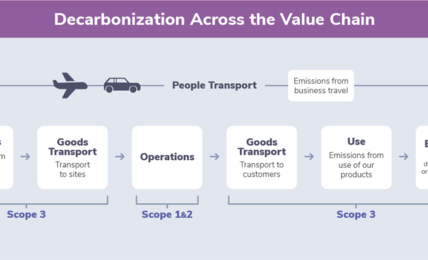

Sustainability linked securities are an emerging form of sustainable finance instruments, with attributes including interest payments tied to an issuer’s achievement of specific sustainability targets. AB InBev’s new credit facility incorporates a pricing mechanism that incentivizes improvement in four key performance areas aligned with the company’s 2025 Sustainability Goals, including water stewardship, circular packaging, renewable energy and emissions reduction. Specific goals include improving water efficiency in breweries globally, increasing PET recycled content in PET primary packaging, sourcing purchased electricity from renewable sources, and reducing GHG emissions as a part of the company’s science-based targets.

Fernando Tennenbaum, AB InBev CFO, said:

“We are excited by the further integration of sustainable finance principles into the capital markets and welcome the opportunity to embed these practices deeper into both our finance organization and the broader company. Our business is closely tied to the natural environment, and it is imperative that we continue to strengthen our leadership in addressing the increasing threats of climate change. Our business and our communities depend on it.”

AB InBev’s SLL RCF is provided by a consortium of 26 leading global financial institutions, with ING and Santander acting as Joint Sustainability Coordinators.

Steven van Rijswijk, CEO of ING, said:

“This major sustainability-linked loan is an important milestone for both AB InBev and the beverage sector as a whole. AB InBev has demonstrated a clear ambition level by incorporating a broad set of material sustainability targets into this core lending facility. I’m proud that ING is supporting AB InBev toward their goals with this sustainable financing structure and at the same time implementing our strategy to help our clients to address climate risks and steer towards a circular economy.”

José M. Linares, Senior Executive Vice-President of Banco Santander and Global Head of Santander Corporate & Investment Banking, added:

“We have a long-standing relationship with AB InBev and are delighted to support the company with this milestone transaction that aligns our institutions’ sustainability priorities. This deal demonstrates AB InBev’s ambition to drive positive change and lead the way in innovation.”

The post AB InBev Makes History with Largest-Ever Sustainability Linked Revolving Credit Facility appeared first on ESG Today.