Zurich-based Direct Air Capture (DAC) startup Climeworks announced that it has raised CHF 600 million (nearly USD$650 million) in an equity funding round led by global private markets firm Partners Group and Singapore sovereign wealth fund GIC. The funding will be used to scale Climework’s Direct Air Capture capacity.

Additional investors included Baillie Gifford, Carbon Removal Partners, Global Founders Capital, M&G, and Swiss Re.

DAC technology, listed by the IEA as a key carbon removal option in the transition to a net zero energy system, extracts CO2 directly from the atmosphere for use as a raw material or permanently removed when combined with storage. According to the landmark IPCC climate change mitigation study released this week, scenarios that limit warming to 1.5°C include carbon dioxide removal methods scaling to billions of tons of removal annually over the coming decades, with DAC positioned to potentially account for a significant portion of the total.

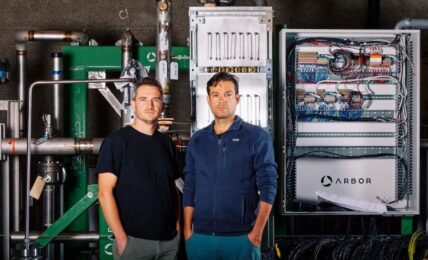

Founded in 2009 by Christoph Gebald and Jan Wurzbacher, Climeworks has emerged as the leading DAC provider, with 15 plants built globally to date, including Orca, the world’s largest DAC and storage facility, which began operations in Iceland in September.

Wurzbacher said:

“We founded Climeworks with the vision to provide the world technology that has the potential to reverse climate change. Accelerating the scale up of carbon removal capacity will play a crucial role in global efforts to keep global warming under 1.5°C, positively impacting the lives of billions of people. And this is what we will do starting now.”

Climeworks’ direct air capture machines are powered solely by renewable energy or energy-from-waste. The machines consist of modular carbon dioxide collectors, that draw in air with fans and capture CO2 on the surface of a highly selective filter material, and extracts the high-purity, high-concentration carbon dioxide. At the Orca facility, Climeworks has partnered with CO2 storage solutions provider Carbfix to mix the captured carbon dioxide with water, and inject it deep underground, where it will ultimately turn into stone through natural mineralization. According to the company, the process can be applied in other areas of the world where renewable energy and geological storage options are available.

Alfred Gantner, Co-Founder and Executive Member of the Board of Directors, Partners Group, said:

“Climeworks‘ DAC plants are part of a portfolio of carbon removal technologies that are essential to achieving the Paris Agreement goals. The scalability of Climeworks‘ technology makes it ideally suited to our transformational investing strategy and positions the Company to make a significant contribution to global carbon removal efforts. We are also attracted to Climeworks due to its close fit with our commitment to achieving lasting, positive stakeholder impact.”

Climeworks stated that the new funding will unlock the next phase o the company’s growth, with plans to scale DAC up to multi-million-ton capacity.

Gebald said:

“We are proud to partner with our new investors and thankful for the renewed trust of our existing ones, all committed to the long-term journey of Climeworks. It is thrilling to see the appetite and support of globally leading investors towards the scale up of our technology; this is a great milestone for our company as well as the entire industry.”

Choo Yong Cheen, Chief Investment Officer of Private Equity, GIC, added:

“We believe that DAC technology will play a crucial role in decarbonisation globally, and that Climeworks will lead this transformation.”

The post Climeworks Raises $650 Million to Scale Direct Air Capture Capacity appeared first on ESG Today.