Global alternative asset and private equity investor KKR announced the release of its 2024 Global Macro Outlook, identifying decarbonization, and the large scale “brown-to-green” transition of asset-heavy sectors in particular, as a key “mega-theme” driving investment opportunities.

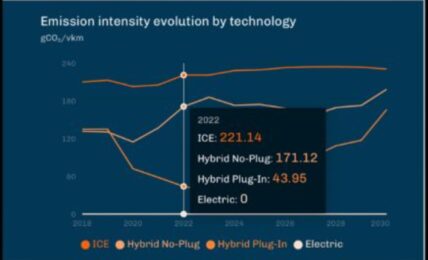

In the report by Henry McVey, CIO of KKR’s Balance Sheet and Head of Global Macro and Asset Allocation, KKR notes that while decarbonization efforts to date have been primarily focused on “asset light” technology-driven advances, investments going forward that aim to enable at-scale climate impact will likely be “much more asset-heavy in nature,” generating large scale opportunities targeting the larger, more emissions intensive sectors of the global economy.

Specifically, the report to opportunities created by the “requirements for decarbonizing the traditional power generation, property, transportation, and industrial sectors,” in addition to the need to upgrade global supply chains, buildings and data centers.

The report follows a series of climate-focused and sector decarbonization moves by KKR, including the launch in August of a global climate strategy team, which the firm said marked an expansion on its focus on climate investing, as well as recent investments including a $750 million allocation to transport and grid decarbonization solutions company Zenobē, and the $1.7 billion acquisition earlier this month of energy and electrification solutions company Smart Metering Systems (SMS).

The report also highlights climate-related opportunities from the emergence of AI technologies, and of new forms of energy that “will require the footprint of energy distribution to be reworked,” adding:

“This reconfiguration represents a major opportunity for both Infrastructure and parts of Private Equity, we believe.”

Additional mega-themes highlighted by the outlook report included “Industrial Automation,” “Security of Everything,” Intra-Asia Connectivity,” “Labor Productivity/Work Force Development,” and “Artificial Intelligence.” Click here to access the report.