Sustainability software provider osapiens announced today that it has raised $100 million in a new Series C fundraising round, led by BlackRock and Temasek’s decarbonization-focused fund, Decarbonization Partners, at a “unicorn” valuation of greater than $1 billion.

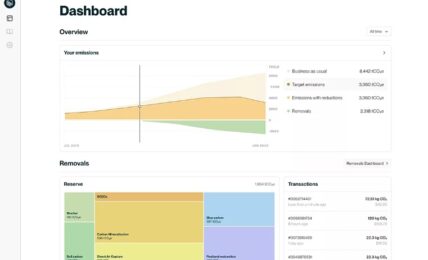

Founded in 2018, Mannheim, Germany-based osapiens provides cloud-based software solutions aimed at enabling organizations to automate complex compliance tasks, streamline operations, and monitor sustainability metrics in real time, and to comply with national and international sustainability regulations. The company’s AI-powered platform, osapiens HUB, includes more than 25 solutions, including transparency solutions enabling companies to map and monitor value chains to mitigate risk and comply with regulatory requirements, and efficiency solutions to help support asset performance, maintenance, planning, and field service operations.

osapiens said that the proceeds from the new financing round will be used by the company to accelerate product innovation and fuel growth in existing and new international markets. The company recently announced the acquisition of Berlin-based agentic AI-focused risk management solutions provider Lucent AI, and in July 2025 unveiled plans to invest $40 million to drive its expansion into the UK market. osapiens raised $120 million in its Series B round in 2024, led by Goldman Sachs Alternatives.

Alberto Zamora, Co-CEO and Co-Founder of osapiens, said:

“Decarbonization Partners is an exceptional partner for us. With a focus on sustainability and the combined global presence and investment expertise of BlackRock and Temasek, they bring exactly the perspective and scale we need for our next phase of growth to become the indisputable global category leader in sustainable growth for enterprises of all sizes.”

Decarbonization Partners was launched by BlackRock and Temasek in 2022, establishing a late-stage venture capital and growth private equity partnership to invest in companies providing technologies and solutions that help accelerate the transition to a net zero economy by 2050.

Dr. Meghan Sharp, Global Head and Chief Investment Officer of Decarbonization Partners, said:

“osapiens is redefining how companies achieve transparency, compliance, and operational excellence across increasingly complex supply chains. Enterprises around the world are looking for trusted, scalable software to meet rising regulatory, sustainability and decarbonization expectations. osapiens’ platform delivers the clarity organizations need to operate and grow responsibly.”