Investment giant BlackRock announced the launch of the BlackRock Global Funds [BGF] Brown to Green Materials Fund, a new fund aimed at targeting materials sector-related investment opportunities stemming from the transition to a low carbon economy.

According to BlackRock, the new fund launch comes as most of the investment focus for the low carbon transition theme has been centered on areas such as renewables or electric vehicles, while “markets may have overlooked the ingredients essential to this infrastructure” creating significant opportunities to invest in companies that supply materials that are key to the transition, or carbon-intensive companies – – in industries such as metals and mining, cement, and construction – that have credible transition plans, and are set to re-rate as they decarbonize and reduce sustainability risk.

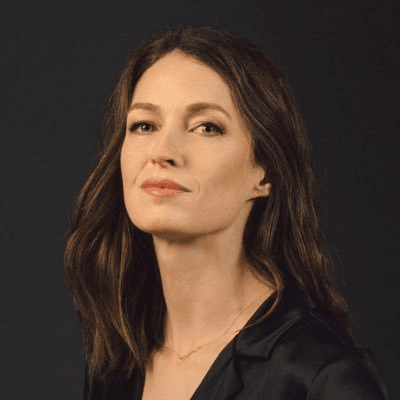

Evy Hambro, Global Head of Thematic and Sector Investing at BlackRock, and one of the managers of the new fund, said:

“As transition materials companies prepare for significant growth, many are also focusing on reducing their own emission intensities. We expect to see a re-rating for materials companies that best navigate a transition. We’ve created the BGF Brown to Green Materials Fund to provide clients with exposure to this significant investment opportunity.”

The new fund will hold a concentrated portfolio of 30-60 global companies across a range of market caps, in categories including “Emissions reducers,” or materials companies with plans to reduce emissions intensity or dedicating more than 30% of capex into carbon reduction strategies; “Enablers,” including companies that generate a significant proportion of revenues from lower carbon end markets, or from solutions that help materials companies reduce their own emissions, and; “Green leaders,” including materials companies in the 1st quartile for the MSCI Carbon Emissions Score in their industry.

The fund, which will be classified as Article 8 under SFDR, will be managed by Hambro, Olivia Markham and Hannah Johnson in BlackRock’s Thematics and Sectors team.

Markham said:

“A low carbon transition sees the global economy moving from an energy system that is fossil fuel and carbon-intensive, to one where the critical inputs are materials and metals. Following a period in which producers’ capital discipline has led to supply constraints, this is an exciting structural demand story that we expect to lead to significant value creation opportunities for investors.”

The post BlackRock Launches “Brown to Green” Transition-Themed Materials Fund first appeared on ESG Today.

The post BlackRock Launches “Brown to Green” Transition-Themed Materials Fund appeared first on ESG Today.