Pension Insurer Rothesay Commits to Net Zero in Investments and Operations

UK-based Pension insurance company Rothesay announced today new sustainability commitments, aimed at supporting the transition to a low carbon economy in the UK, including plans to reduce emissions in its investment portfolio, targeting net-zero by 2050.

In its “Pathway to Net Zero” programme set out in its first ESG Report, Rothesay unveiled several climate commitments encompassing the company’s operations and investments. New goals include becoming carbon neutral or negative in operations by 2023, reducing the carbon intensity of its investment portfolio by 2025, and embedding climate responsibility across all areas of its business, in addition to the 2050 net zero target.

Rothesay also said that it will partner with governments, and industry, to identify ways to increase lending to sectors that support a low carbon economy, and issued a call on the government to support the bulk annuities sector to increase its investment in green infrastructure.

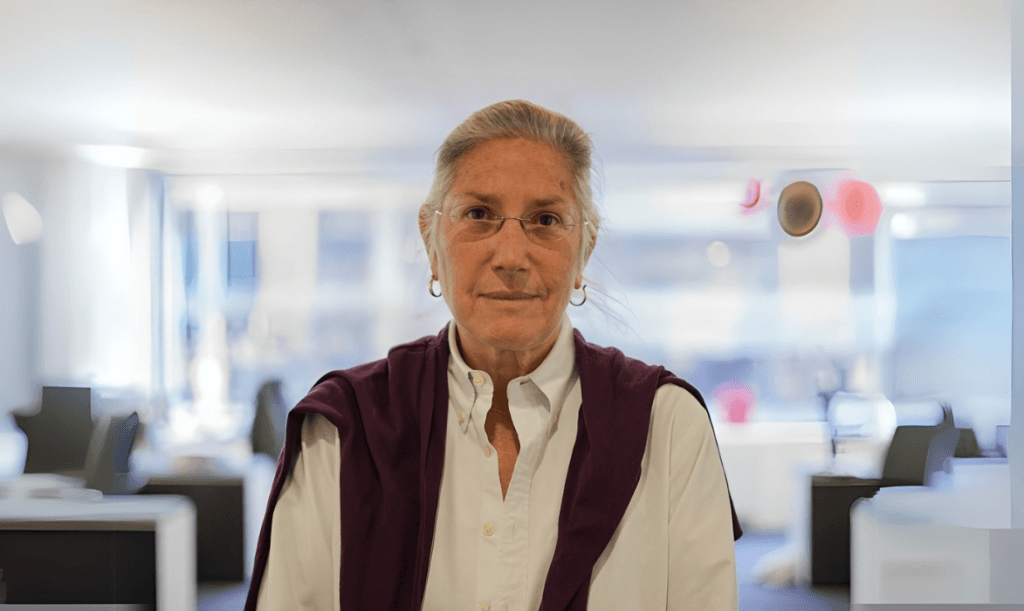

Addy Loudiadis, CEO of Rothesay, said:

“Rothesay is dedicated to securing the future for every one of our policyholders. It is therefore vital that we carefully measure and manage the risks associated with climate change in our investment portfolio and that our lending is aligned with businesses that will successfully navigate these risks in the future. We actively seek out opportunities to help finance renewable energy projects, where this is possible, and we are always willing to support governments in their efforts to develop low carbon generation and infrastructure. We stand ready to further fund projects that aid the transition to a low carbon economy.”

The post Pension Insurer Rothesay Commits to Net Zero in Investments and Operations appeared first on ESG Today.