JPMorgan enters green ETF arena with carbon fund

J.P. Morgan Asset Management is throwing its hat into the rapidly expanding universe of green funds.

The JPMorgan Carbon Transition U.S. Equity exchange-traded fund (JCTR) will begin trading on the New York Stock Exchange Thursday. The firm’s first U.S. ETF focused on environmentalEnvironmental criteria consider how a company performs as a steward of nature., socialSocial criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. and governanceGovernance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. standards will be passively managed and track a gauge that screens the Russell 1000 Index for companies seeking to reduce their carbon footprint.

“The carbon space is something that’s particularly interesting. It’s quantifiable, it’s something that everybody can kind of put their fingers on and understand,” said Bryon Lake, head of Americas ETF at J.P. Morgan Asset. “ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments., sustainable, is coming up more and more in the client conversations that we’re having, particularly sophisticated asset allocators, and so we’re really looking to meet that need with what we think is a super compelling investment proposition.”

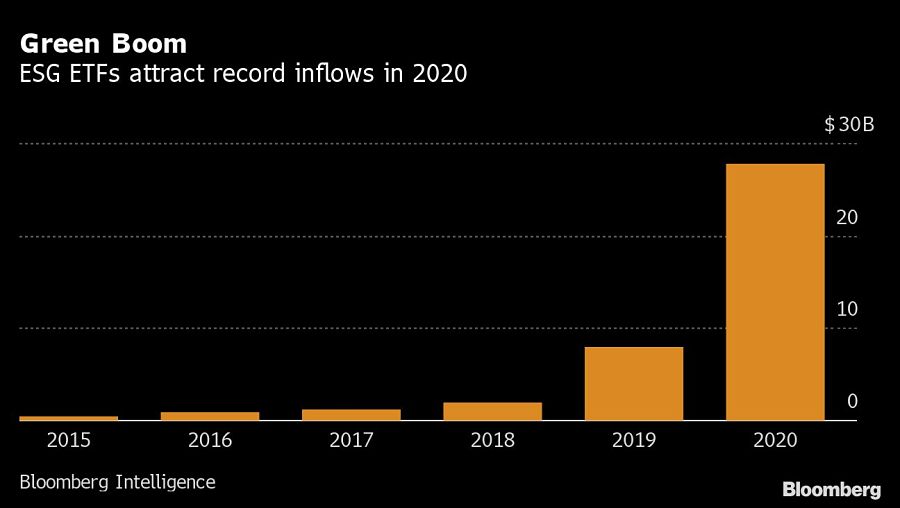

As the world grapples with the coronavirus pandemic, devastating weather and racial unrest, U.S. ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. funds have lured a record $27.9 billion worth of inflows in 2020, according to Bloomberg Intelligence data. Those ETFs currently have about $61 billion in assets.

[More: Green investments rally ahead of potential ‘blue wave’ election]

The new fund will evaluate Russell 1000 companies based on three main criteria: emissions, resource management and risk management. All told, JCTR whittles the Russell 1000 down to roughly 200 holdings, Lake said. Its constituents are selected from companies actively seeking to reduce their carbon footprint, according to Lake.

“Instead of just going through and deleting out the worst offenders, that gets you to only part of the answer. How companies are actually managing that transition is a much more interesting and compelling answer,” Lake said. “If it’s a heavily carbon-producing company, but they’re dramatically changing their behavior — the emissions piece and the risk management piece — that’s what we believe is more compelling.”

[More: New York pension fund pledges net-zero emissions by 2040]

The post JPMorgan enters green ETF arena with carbon fund appeared first on InvestmentNews.