Sustainability data and technology company ESG Book announced today the launch of LEO, a new sustainability data sourcing and reporting platform, developed in partnership with Boston Consulting Group (BCG).

According to ESG Book, the new solution is aimed at streamlining data sourcing and reporting, addressing challenges facing companies and financial institutions in meeting sustainability due diligence and disclosure requirements, particularly as the requirements change, creating widening data gaps and making data collection inefficient and incomparable.

Justin Fitzpatrick, CEO of ESG Book, said:

“As regulatory requirements evolve, managing risks and leveraging sustainability as an economic driver remains crucial for corporates and financial institutions. LEO cuts through complexity, simplifies reporting, and helps businesses focus on what matters – using data to drive efficiency, reduce costs, and create long-term value.”

Built on Google Cloud, the new solution is powered by ESG Book’s disclosure platform and BCG’s Climate and Sustainability Data Template, providing access to more than 200,000 disclosures.

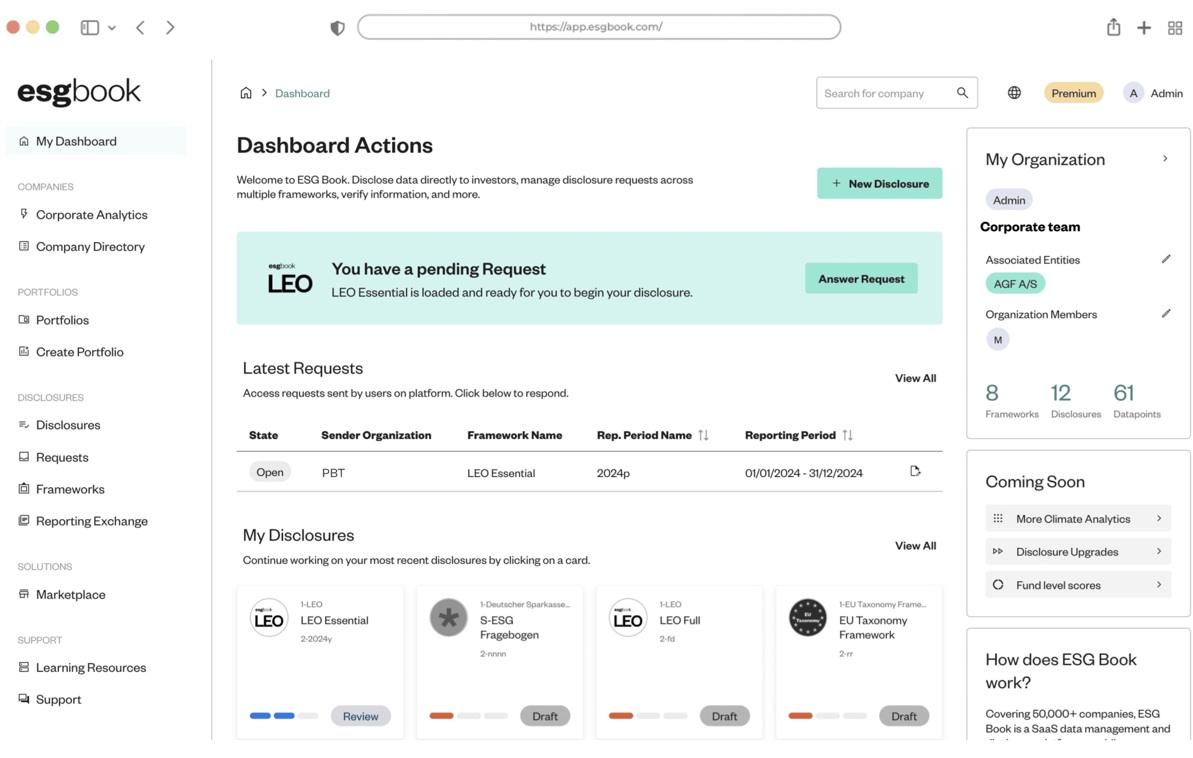

Key features of the new platform for corporates include the ability to manage disclosure requests and map data across multiple frameworks, pre-fill capabilities to reduce reporting burdens, secure data sharing with multiple counterparties, and centralized data management and control access. For financial institutions, capabilities include automated and standardized data collection from clients and vendors, EBA Pillar 3 and Basel III compliance features, and support for streamlining data access to support critical use cases including risk management and opportunity creation and to improve data response rates from suppliers.

Roy Choudhury, Managing Director and Senior Partner, BCG, said:

“As the demand for reliable and comparable climate-related information continues to grow, a standardised data request and reporting template is essential. Our collaboration on the LEO platform leverages BCG’s intellectual property and sustainability expertise to foster an innovative response to this challenge. The platform provides a common framework that helps companies respond more efficiently, making decision-useful information easier to access and interpret. This is especially valuable when requesting data from privately held companies, where these disclosures are often limited.”

ESG Book said that the new platform is currently being adopted or piloted by financial institutions including ING, Lloyds, and NatWest.