- Pact commits European states to jointly develop 100 GW of offshore wind in shared North Sea waters by 2050

- Framework centers on hybrid wind assets, interconnectors, and cross-border grid planning to reduce exposure to volatile fossil markets

- Policy alignment aims to accelerate investment pipelines and reinforce Europe’s energy sovereignty amid geopolitical risk

At the Future of the North Seas Summit in Hamburg, European leaders agreed to drive a new generation of hybrid offshore projects designed to link dozens of gigawatts of wind capacity directly into cross-border grids. The initiative formalizes cooperation among the United Kingdom, Germany, Norway, Denmark, France, Belgium, Iceland, Ireland, the Netherlands, and Luxembourg, and positions the North Sea as a shared strategic clean energy reservoir for the continent.

A Security Story Driven by Geopolitics

The shift toward joint offshore development has fast become a core energy security issue for Europe. Russia’s invasion of Ukraine disrupted pipeline gas flows, distorted power prices, and reanimated debates over sovereignty and fossil exposure. European governments have responded with structural reforms, prioritizing auctions, cross-border grid planning, interconnectors, and emissions trading system alignment.

Three years ago North Sea countries set a collective goal to reach 300 GW of offshore wind by mid-century. The Hamburg Declaration refines that ambition by designating 100 GW of that target for joint projects rather than standalone national fleets. These projects will use hybrid offshore assets that plug wind farms into multiple countries at once, routing electrons to where demand and pricing are strongest.

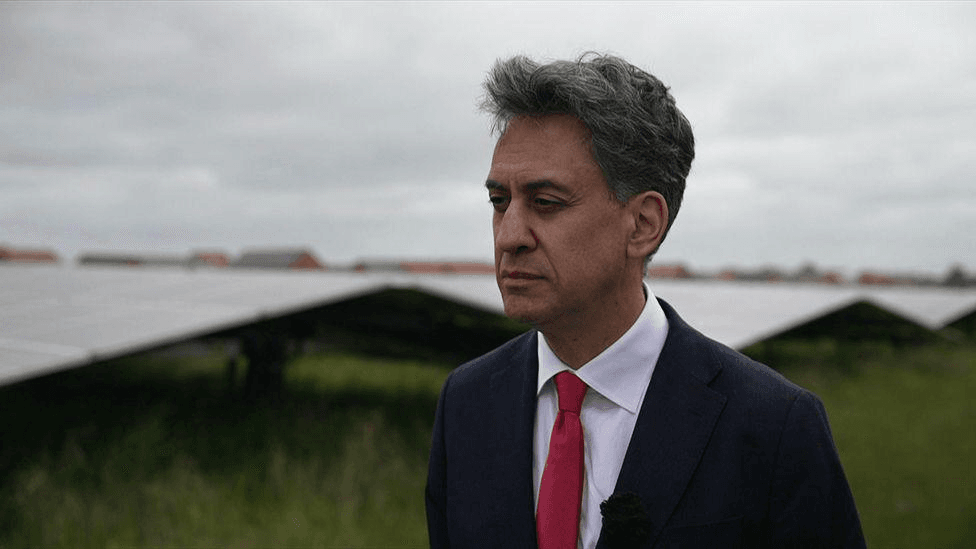

Energy Secretary Ed Miliband framed the agreement in sovereignty terms. He said “We are standing up for our national interest by driving for clean energy, which can get the UK off the fossil fuel rollercoaster and give us energy sovereignty and abundance. After our record renewables auction, we today went further by signing a clean energy security pact with European allies to ensure we maximise the clean energy potential for the North Sea.”

Financing, Infrastructure, and the Interconnector Bet

The offshore cooperation agenda is capital intensive. It requires not only turbines and seabed leases but also subsea cables, converter platforms, market coupling systems, and new regulatory frameworks for cost sharing and revenue allocation. European investors have grown increasingly focused on the interconnector thesis as a hedge against market fragmentation and a route to portfolio flexibility.

The UK enters the pact with momentum. Its latest offshore wind auction delivered 8.4 GW, the largest single auction in European history, unlocking an estimated wave of private investment across ports, fabrication yards, and transmission assets. Industry is expected to outline further project pipelines as policy clarity improves across the Channel.

Hybrid assets represent a new class of infrastructure in the offshore stack. They combine wind farm connections with subsea interconnectors, enabling cross-border balancing and improving capacity utilization. The summit produced a statement of intent among Germany, Belgium, Denmark, the Netherlands, and the UK to advance planning, cost sharing, and market arrangements to accelerate deployment.

Ben Wilson, president of National Grid Ventures, said North Sea integration will reduce costs and resource duplication while improving efficiency for consumers. Dhara Vyas, chief executive of Energy UK, argued that the cooperation targets will require sustained UK EU alignment on market coupling and emissions trading. Enrique Cornejo, energy policy director at Offshore Energies UK, noted that offshore wind will sit alongside oil, gas, and hydrogen in the North Sea mix for decades, with affordability and security central to the transition.

RELATED ARTICLE: UK Wind Power Hits Historic 30GW Milestone

Regulatory Alignment and Market Design

The credibility of the 100 GW target hinges on regulatory interoperability. European policymakers continue to work on reforms to electricity market design, cross-border balancing, ETS linkage, and state aid guidelines. The offshore pact adds a strategic layer by encouraging alignment on supply chains, cable manufacturing, grid integration, and permitting.

C-suite readers will note that permitting remains the key bottleneck for offshore timelines in Europe. Countries are experimenting with spatial planning reforms, sovereign guarantees for transmission assets, and standardized auction formats to draw capital at scale. The Hamburg framework points toward shared planning and grid rationalization, which could reduce duplication of converter platforms and seabed corridors.

What Investors and Strategists Should Watch

Investors will track three variables. First, how hybrid assets are financed, including whether they attract regulated returns or merchant exposure. Second, whether market coupling deepens sufficiently to move power across borders without price distortions. Third, how Europe balances competition among national champions with cooperative buildout that maximizes resource access.

The pact also places the North Sea at the center of Europe’s emissions trajectory. Offshore wind already forms the backbone of national net zero pathways across the EU and UK. By 2030, Europe aims to deploy between 60 and 80 GW of offshore capacity, with a rising share dedicated to hybrid and cross-border integration.

Global Relevance

The Hamburg Declaration carries implications beyond Europe. Other regions exploring transnational offshore corridors, including East Asia and the Gulf of Mexico, are watching the regulatory and financing mechanisms emerging in the North Sea. The framework sets a precedent for using shared marine basins to reduce geopolitical exposure, pool capital, and accelerate decarbonization.

Europe’s cooperative offshore model will not resolve security risks overnight. It does, however, reshape how a region with limited fossil resources can leverage renewables, interconnectors, and market design to harden its energy system. With 100 GW of joint projects now on the table, Europe has signaled that energy security and clean power are converging into a single industrial and geopolitical strategy.

Follow ESG News on LinkedIn

The post UK, EU Target 100 GW Joint Offshore Wind to Strengthen Energy Security appeared first on ESG News.