Global integrated risk assessment company Moody’s announced today the acquisition of RMS, a leading provider of climate and natural disaster risk modeling and analytics, for $2 billion from Daily Mail and General Trust plc.

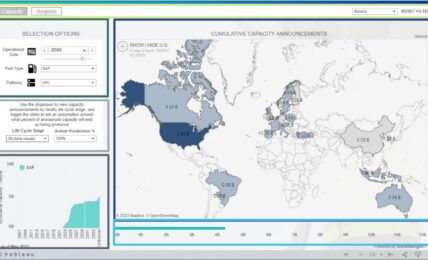

RMS is a leading provider of climate and natural disaster risk modeling serving the global property and casualty (P&C) insurance and reinsurance industries. The company’s solutions enable organizations to evaluate and manage risks from events such as hurricanes, earthquakes, floods, climate change, cyber, and pandemics.

The acquisition comes as investors, regulators and stakeholders demand that companies manage a broader range of risks. Through the combination, Moody’s and RMS aim to enable insurers and financial service providers understand, measure, and manage risk in new ways.

Rob Fauber, President and Chief Executive Officer of Moody’s, said:

“Today’s leaders face a complex, interlinked world of risks and stakeholders. In the context of a global pandemic, the climate crisis and increasing cyberattacks, our customers must manage a wider range of risks than ever before. We are excited to add RMS and its team of world-class data scientists, modelers and software engineers to the Moody’s family to help accelerate solutions that enable customers to build resilience and make better decisions.”

According to Moody’s the deal will significantly accelerate the company’s integrated risk assessment strategy for customers in and beyond the insurance industry. With estimated RMS revenues of approximately $320 million, the acquisition immediately boosts Moody’s insurance data and analytics business to nearly $500 million in revenue. The companies have complementary customer bases, with Moody’s providing risk and finance solutions for life insurers, and RMS focusing on climate and catastrophe risk modeling solutions for P&C insurers and reinsurers.

Karen White, Chief Executive Officer of RMS, said:

“Moody’s is an exceptional fit for RMS and our customers. Global risks are now more complex, connected and systemic. Climate change and catastrophic events like extreme weather, pandemics and cyberattacks have broader and more harmful impacts across virtually all industries. We share the vision to bring a global, integrated risk assessment platform to our markets with the goals of deeper, more sophisticated risk insights and greater global resiliency. Within Moody’s, I’m confident RMS will be able to accelerate technology and model innovations while combining with Moody’s core data and analytics offerings for powerful, holistic solutions. The team and I are excited to bring new value to customers as we transform how we are able to understand and mitigate the future of risk.”

The acquisition is expected to close in late 3Q 2021.

The post Moody’s Acquires Climate and Natural Disaster Risk Assessment Provider RMS for $2 Billion appeared first on ESG Today.