Interview: Dydon AI CEO Dr. Hans-Peter Güllich on Digitalising the EU Taxonomy

Dr. Hans-Peter Güllich is the founder and CEO of Dydon AI, a Swiss company offering transparent and flexible AI solutions for Sustainable Finance (Fintech), Insurtech, and Medtech. His professional experience spans more than 25 years, most of which with consultancies, financial institutions, and IT solution providers. He made significant contributions to the development of numerous risk management systems (credit and operational risk), founding also a leading vendor of a cross-industry IT solution for governanceGovernance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. More, risk, and compliance management (Avanon AG) acquired years later by Thomson-Reuters.

We discussed several topics with Hans-Peter, including the challenges facing investors and companies in complying with the EU Taxonomy, and the use of AI solutions to address those issues.

The EU taxonomy provides companies, investors, and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable. This should create security for investors, protect from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments towards sustainable activities – one of the core objectives of the Paris agreement already back in 2015.

But the complexity of the EU Taxonomy regulation is extremely high and the challenges of financial institutions are at different levels, from operational aspects to the ones related to what is close to my area of competence in artificial intelligence, that are data and its assessment and management.

Data available to banks are typically data made available by companies voluntarily, either publicly or directly, and data made available by larger companies that fall under the scope of the NFRD (Non-Financial Reporting Directive).

SMEs and smaller counterparties are generally not in a position to disclose relevant information since they lack the resources, expertise, and incentives to produce the data necessary to present adequate documentation. Publicly available data on SMEs, whether produced by the company or from an independent source, are high level and often inadequate to provide an appropriate assessment against the EU Taxonomy.

Besides data availability, other challenges include quality, comparability, standardization, relevance, verification, and time to capture and or assess. Challenges relating to data go beyond the currently regulated climate mitigation and adaptation and may be exacerbated when the subject matter is complex or demands sector expertise.

At an operational level, financial institutions need to link the EU Taxonomy classification to clients’ business activities, and that’s not easy since there is no correspondence with pre-existing classification schemes.

The introduction of the EU Taxonomy is requiring financial institutions to increase the documentation and also the time necessary to analyze it. In addition, in terms of internal organization, new IT development costs for specific tools arise, a common nomenclature necessary for data collection and automation has to be shared, employees need to be trained on the topic, and the increased complexity is leading to the risk of errors from inconsistent application of the EU Taxonomy.

A digitalization process is strongly needed to support financial institutions, investors, companies, and also all those not being affected by the EU Taxonomy directly, but who want to get funding.

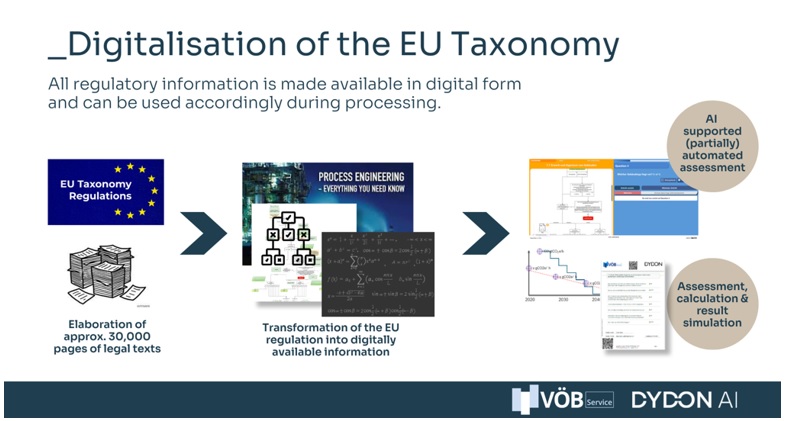

The EU Taxonomy is a new regulatory mammoth project with enormous implications and high bureaucratic costs. The legislation documents of the EU taxonomy are approximately 30,000 printed pages and due to the ongoing regulatory integrations, the number is constantly growing. In addition, a large number of publicly available data sources must be used to calculate CO2 emissions and energy values.

The digitalization of the EU Taxonomy was and still is a long and challenging development process to build an AI-based software managing the alignment for each economic activity.

The EU Taxonomy regulation currently identifies 88 economic activities (plus 6 additional – for gas and nuclear-related activities – that will be added till the end of the year) and for each of them, there is a complex interpretation of the criteria and related data.

Each economic activity has also different types of documents, and certifications to be fulfilled. Bear in mind, that within the European Union different country-specific definitions (e.g. energy consumption thresholds for buildings, carbon emissions per country-specific energy mix, etc.) do exist, also to be considered by a digitized EU Taxonomy service.

As Founder and CEO of Dydon AI, could you tell us the advantages of using an AI software?

With Artificial Intelligence, we want to make the evaluation process of a company or a project as easy and quick as possible, for financial institutions dealing with their customers and also for corporates who need to be compliant with the taxonomy.

This is exactly the goal of the TAXO TOOL, the AI-Suite that Dydon AI developed in cooperation with Bundesverband Öffentlicher Banken Deutschlands (VÖB), and its subsidiary VÖB-Service for implementing the EU taxonomy for sustainable investments.

With the TAXO TOOL, the complexity of the technical evaluation criteria of the EU taxonomy for sustainability are mapped in one system and, as far as currently possible, automated processes are made possible. In this way, processes can be partially automated and costs can be significantly reduced.

Financing projects or financial products can thus be analyzed and evaluated as aligned with the EU taxonomy. The integration of physical and procedural fundamentals provides an efficient solution, even when it comes to project financing, individual projects or small companies that are not subject to NFRD reporting (e.g. municipal utilities). Process engineering models are used, which also enable an evaluation if basic data is not completely available.

See below for more information on TAXO TOOL*.

What emerges in our daily exchange with the financial institutions is that each economic activity has huge differences in terms of documents that need to be processed, and these differ also from country to country.

We are continuously working on our NLP (Natural Language Processing) process stack in order to improve and optimize the automatic acquisition of data, ideally allowing the single banking employee to process the assessment in only few clicks.

Furthermore, the continued usability enhancement is a core objective where we are working closely with the existing user group. Also, as I mentioned before, bear in mind, that the regulation is not finished yet. Out of the ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More, only a portion of the “E” has been regulated yet, and as of now only 2 out of 6 of the main objectives of the EU Taxonomy have been regulated:

(1) climate change mitigation (regulated)

(2) climate change adaptation (regulated)

(3) sustainable use and protection of water and marine resources

(4) transition to a circular economy

(5) pollution prevention and control, and

(6) protection and restoration of biodiversity and ecosystems.

We therefore have created the TAXO TOOL service based on a flexible AI platform, allowing us to easily adjust the service to the latest regulatory requirements, with many more to come over the next years.

*The main advantages of using the TAXO TOOL are:

Strong knowledge base: The uniqueness of the TAXO TOOL AI-software is that it has its own CO2 emission database consisting of process engineering referring to all the economic activities regulated by the EU Taxonomy to date, enabling an assessment even if basic data is not fully available.Transparency: transparency and auditability of the results are essential in this AI Suite. This helps all companies having transparency requirements. For us transparency means that the causes for a certain result can be evaluated and understood. This is what we call an “open box” system. I see transparency on sustainability issues as a prerequisite to enable financial market actors to properly assess the long-term value creation of companies and their management of sustainability risks.Possibility to combine the EU Taxonomy with ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More performance management and Supply Chain Risk monitoring, thanks to our comprehensive sustainable finance AI Suite.

If you want to know more about how the assessment works with the TAXO TOOL, you can register for our monthly free webinars, next date coming up is on 22nd June 2022.

More about Dydon AI

Get a Demo

The 3 modules of Dydon AI’s sustainable finance AI Suite

The post Interview: Dydon AI CEO Dr. Hans-Peter Güllich on Digitalising the EU Taxonomy appeared first on ESG Today.