Qontigo, SDI AOP Launch Dashboard Enabling Investors to Assess Portfolio Alignment with SDGs

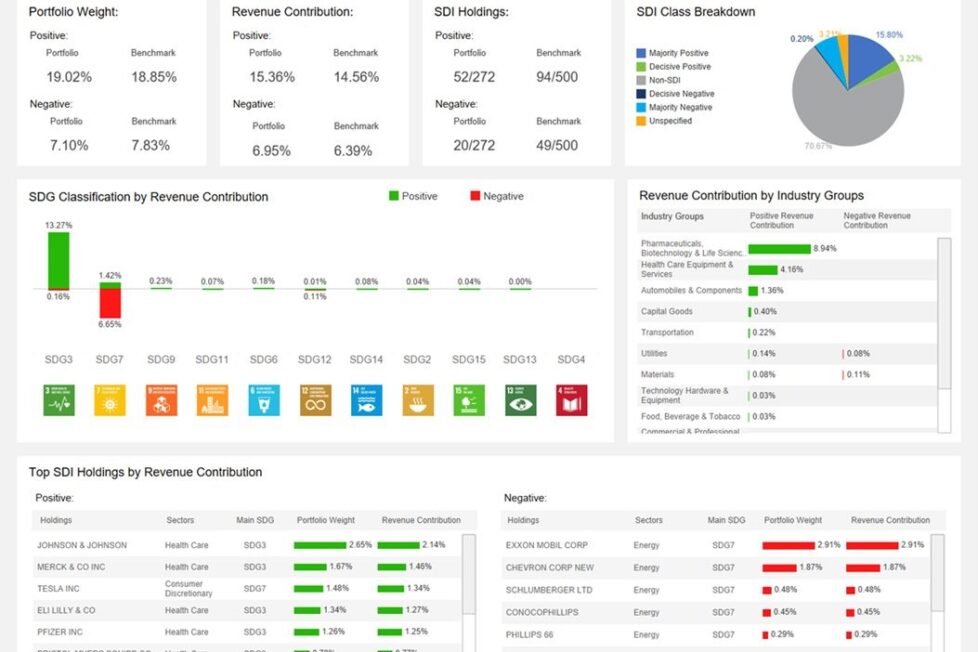

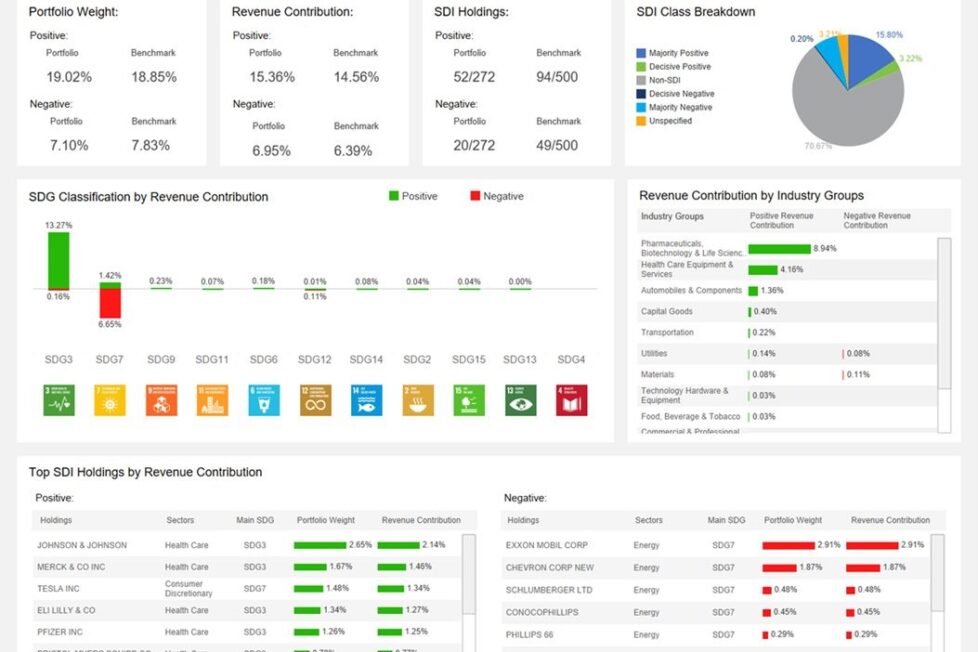

Risk, analytics, and index solutions provider Qontigo and asset management coalition the Sustainable Development Investments Asset Owner Platform (SDI AOP) announced today the launch of the SDI Dashboard, a new tool enabling investors to upload investment portfolios and analyze them across UN Sustainable Development Goals (SDG)-related parameters.

Launched in 2020 by pension asset managers APG, AustralianSuper, British Columbia Investment Management Corporation (BCI) and PGGM, SDI AOP was established to investors to assess companies on their contribution to the SDGs, the 17 categories of goals adopted as part of the 2030 Agenda for Sustainable Development, with the aim to protect the planet and improve the quality of life globally, with targets such as ending poverty and hunger, improving education, and protecting the environment.

SDI AOP’s data universe includes more than 9,000 companies, classified according to their product and service-related revenue contributions to the SDGs.

The new tool includes various dashboards across multiple use cases, including portfolio overview for SDI monitoring and client reporting, breakdowns by SDI status, assessment of positive and negative revenue contributions, as well as research and portfolio management such as SDI analysis relative to a client benchmark and identification of top positive and negative SDI holdings.

James Leaton, Research Director, SDI AOP, said:

“Qontigo developed the SDI Dashboard to enable the investment community to easily assess their portfolios in terms of fulfilling sustainability criteria.

“Multiple portfolios can be uploaded using Qontigo’s cloud-based platform. The individual instruments are then mapped to our SDI universe and an aggregated portfolio view as well as various drill-down views are made available.”

The post Qontigo, SDI AOP Launch Dashboard Enabling Investors to Assess Portfolio Alignment with SDGs appeared first on ESG Today.