ESG Book Launches In-Depth Company ESG Performance Scores

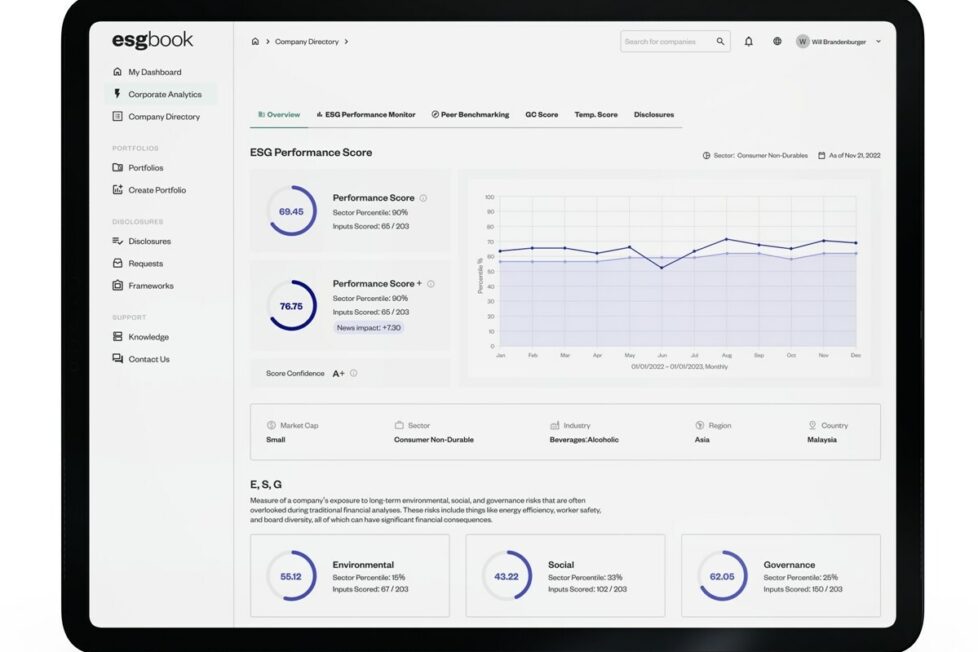

Sustainability data and technology company ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Book announced today the launch of its new ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Performance Score, aimed at providing in-depth, transparent and materiality-focused assessment of companies’ sustainability performance.

According to ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Book, the new solution was developed to address market challenges around current sustainability ratings offerings, including a lack of transparency into scoring methodology, insufficient standardization, and limited measurement of industry and sector-specific metrics. Regulators have been taking note of these issues, and have been moving to take action, including a recent proposal by the EU for ESG ratings providers to be supervised by markets regulator ESMA, and a Code of Conduct for ESG ratings and data providers unveiled in the UK earlier this month at the request of the Financial Conduct Authority.

ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Book CEO Daniel Klier said:

“We are transitioning from a world of simplistic and opaque ratings to an increasingly more advanced sustainability data landscape, and moving on from the past when a single score would be used to explain how a company is performing on ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More and climate issues.”

The new sustainability scores solution include separate analytics on performance and disclosure based on more than 450 standardized ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More and emissions metrics applied to each company, with key transparency-focused features including the ability to access to the score’s framework, data mapping and calculations and to click through from the score-level to the underlying raw data.

The solution also incorporates sector-specific materiality and enables time-series analysis by providing point-in-time history data.

Klier added:

“With the launch of the ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Performance Score, we are empowering investors and corporates with a more accurate tool to determine financially material ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risks and opportunities, and greater transparency to enable more sustainable outcomes.”