Sphera Acquires Supply Chain Sustainability Software Provider SupplyShift

Blackstone-backed ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More performance and risk management software, data and services provider Sphera announced today the acquisition of supply chain sustainability software company SupplyShift, in a move aimed at enhancing its supply chain offering with expanded supplier mapping, scoring and traceability capabilities.

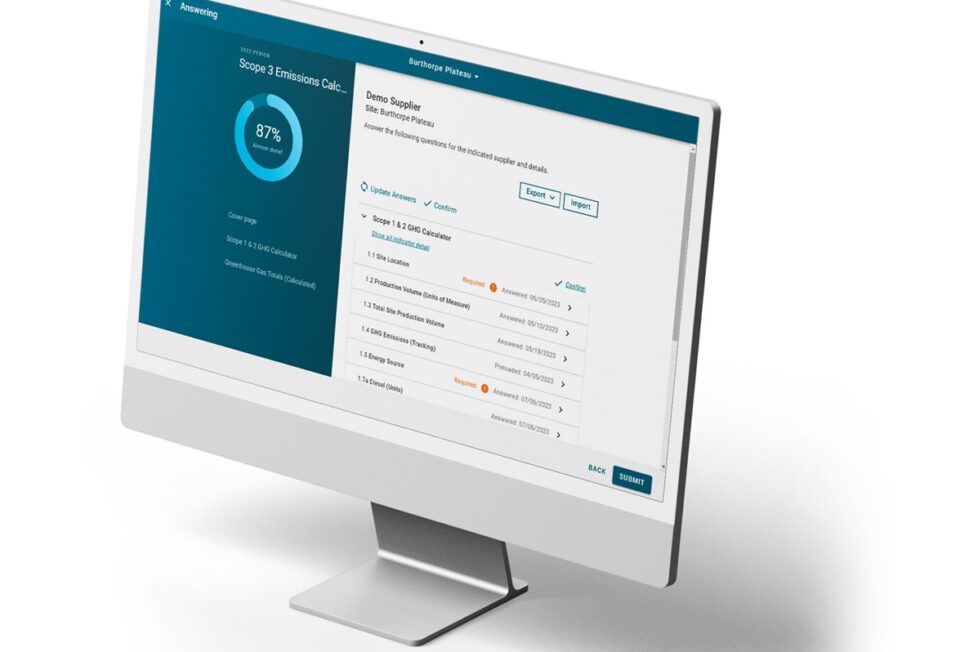

Founded in 2012 by Climate Science and EnvironmentalEnvironmental criteria consider how a company performs as a steward of nature. More Economics PhDs Alex Gershenson and Jamie Barsimantov, Santa Cruz, California-based SupplyShift provides a cloud-based end-to-end supply chain data management, responsible sourcing, and supplier engagement platform aimed at enabling businesses to build transparent, responsible, and resilient supply chains, and to measure, monitor and improve their environmentalEnvironmental criteria consider how a company performs as a steward of nature. More, socialSocial criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. More and economic impact across the supply chain.

SupplyShift’s supply chain network encompasses over 100,000 suppliers, with the platform enabling buyers and suppliers to share information in order to manage risk and facilitate supplier regulatory compliance.

SupplyShift CEO and co-founder Alex Gershenson said:

“SupplyShift was founded on the idea of leveraging software to drive sustainability initiatives, and for 11 years we have been empowering companies to understand their supply chain ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risk and performance. We are excited to join the Sphera family and take data availability to a new level through the combination of Sphera’s industry-leading ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More data and SupplyShift’s Scope 3 data collection abilities.”

The transaction marks the latest move by Sphera to boost its supply chain sustainability capabilities, and follows its 2022 acquisition of supply chain risk management (SCRM) software company riskmethods. The acquisitions come as companies globally face increasing regulatory pressure to report on supply chain sustainability metrics, and particularly on their scope 3 emissions, with emerging sustainability reporting standards including the EU’s CSRD and the IFRS’ ISSB standards requiring scope 3 disclosure.

Sphera CEO and President Paul Marushka said:

“SupplyShift has seen tremendous growth with its software solution that allows for direct communication with suppliers and customers and enables the seamless collection of their Scope 3 emissions data, which helps suppliers improve their supply chain ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More performance. As more regulations are passed that demand transparency, the SupplyShift solution will become indispensable in meeting global regulatory requirements and stakeholder expectations.”

Founded in 2016, Sphera offers SaaS software, proprietary data and consulting services, helping organizations around the world to surface, manage, and mitigate ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risk in the areas of Environment, Health, Safety & Sustainability, Operational Risk Management and Product Stewardship. The company was acquired in 2021 by alternative investment manager Blackstone in a deal valuing Sphera at $1.4 billion.

Eli Nagler, Senior Managing Director, and Kelly Wannop, Managing Director, at Blackstone, said:

“We are excited to welcome SupplyShift to Sphera and continue investing in this company’s innovative solutions. This planned acquisition supports our commitment to Sphera’s accelerated growth and will bolster the company’s supply chain capabilities for its customers moving forward.”