The IFRS Foundation and the Taskforce on Nature-related Financial Disclosures (TNFD) announced today a new agreement, formalizing the collaboration between the organizations to enable nature-related financial disclosures for capital markets, including building upon the TNFD recommendations in the work of the IFRS’ International Sustainability Standards Board (ISSB).

Erkki Liikanen, Chair of the IFRS Foundation Trustees, said:

“We are delighted to be formalising our partnership with TNFD to ensure that the ISSB gives due consideration to the work TNFD have put into creating recommendations for nature-related financial disclosures.”

The TNFD was launched in 2021, building on the success of the Task Force on Climate-related Financial Disclosures (TCFD), to support organizations in reporting and acting on their nature-related risks. The organization published its final recommendations for nature-related risk management and disclosure in September 2023, centered around 14 recommended disclosures, aimed at helping inform better decision-making by companies and capital providers on nature and biodiversity-related risks, opportunities, dependencies and impacts. The organization recently reported that more than 1,700 organizations have joined as members of the TNFD Forum, its network of aligned institutions, and more than 520 companies and financial institutions have committed to begin nature-related corporate reporting, based on the TNFD recommendations.

The IFRS Foundation’s International Sustainability Standards Board was launched in November 2021, with the goal to develop IFRS Sustainability Disclosure Standards to provide investors with information about companies’ sustainability risks and opportunities. The IFRS released the inaugural general sustainability (IFRS S1) and climate (IFRS S2) reporting standards in June 2023.

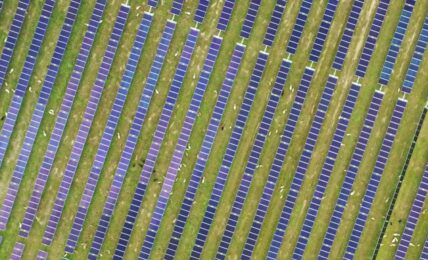

As part of its 2024 – 2026 work plan following the release of its initial standards, the ISSB is researching risks and opportunities associated with sustainability topics beyond climate, including exploring information about sustainability-related risks and opportunities associated with biodiversity, ecosystems and ecosystem services (BEES), and deciding whether to pursue standard-setting for disclosure requirements on these topics.

Under the new agreement, the organizations said that the ISSB and TNFD will share research, knowledge and technical expertise to inform the ISSB’s BEES initiative, as well as the nature-related aspects of its industry-focused SASB standards enhancement work. The ISSB and TNFD also said that they will further explore joint market engagement and capacity-building initiatives, including with other key partner organizations.

TNFD Co-Chair Razan Al-Mubarak said:

“Nature is essential to our economies and our future. Our collaboration with the ISSB is a major step toward making nature visible in businesses reporting and how capital is allocated. Climate-related standards have already moved markets, and we are pleased to continue to support ISSB efforts that bring the rest of nature into global reporting practice.”

The formalized agreement follows a long-time collaboration between the organizations, with the ISSB serving as a TNFD Knowledge Partner since the inception of the TNFD, and the TNFD already working to support the ISSB’s BEES project. The organizations said that the new agreement will deepen their collaboration as the ISSB considers the TNFD recommendations in its research into the needs of global capital markets for information about nature-related risks and opportunities.

Sue Lloyd, ISSB Vice-Chair, said:

“Our collaboration with the TNFD is a clear signal to the market that we are committed to reducing fragmentation in sustainability disclosure while meeting the need for relevant and high-quality information for capital markets.”