By: Jessica Camus, Chief Corporate Affairs Officer, Diginex

As any business looking at EnvironmentalEnvironmental criteria consider how a company performs as a steward of nature. More SocialSocial criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. More GovernanceGovernance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. More (ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More) reporting will know, it is a very complex landscape to deal with. This has not been helped by the rise in demand for ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting by all stakeholders – from investors and employees to consumers – which has led to new standards being developed. As it stands, there are currently globally-recognised frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), as well as dozens of smaller and sector-specific ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More guidelines.

With financial and reputational stakes high, businesses know they need to take ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More seriously. However, many do not know where to start with multiple standards, multiple stakeholders and multiple material issues to balance. With so much choice – and inconsistency – calls for the standardisation of ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting have become louder across the board.

Governments are taking action

Governments around the world are adding their voices to those calling for a greater focus in ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting. We are seeing more and more forward-thinking countries taking matters into their own hands and introducing nation-wide ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More standards to create consistency and make it easier for companies to report on their impact.

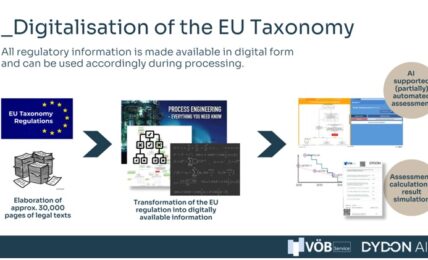

In March this year, the European Union (EU) became the first international organisation to introduce a green taxonomy for the financial sector. The Sustainable Finance Disclosure Regulation (SFDR) makes ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting mandatory for asset managers and requires disclosures to be available on businesses’ websites and in quarterly and annual reports.

Germany is a great example of a country that has taken the initiative to go beyond the provisions of the EU, with an announcement it made in early May that makes ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting mandatory for all sectors as part of its new Sustainable Finance Strategy (SFS).

One of the 26 new measures it announced involves introducing a traffic light system for private investors that would provide ‘at-a-glance’ information on “whether a company takes environmentalEnvironmental criteria consider how a company performs as a steward of nature. More protection and human rights seriously”. The colour awarded to each company will be determined by its ‘score’ based on the government’s sustainability reporting framework. If Germany can prove this model works – both for businesses and their stakeholders – it is likely we will see other countries follow suit in the not-too-distant future.

The United Kingdom is also stepping up its ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More game following its departure from the EU, becoming the first country in the world to make the Task Force on Climate-Related Financial Disclosures (TCFD) mandatory. TCFD issues recommendations on behalf of investors on a variety of climate issues, and it has become a key reference point that investors look to for sustainability disclosures. The UK government also recently announced plans to introduce its own ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More framework, which will align with – but not be bound by – European standards.

The benefits of government-mandated ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting are clear from providing guidance to businesses and creating a single point of reference, to helping businesses become more transparent and reduce the risk of greenwashing. However, as with any new initiative, this needs to be approached with caution so we don’t create an environment where businesses are attracted to countries that waive ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting. Or to put it more simply, an ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More haven for heavily polluting companies.

That said, a U-turn on ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More is likely because sustainable business practices have become such a focal point for a wide range of groups.

A recent survey showed that two thirds of the British public want the UK to become a world leader on climate change, while 65% want the UK to shift the subsidies it currently provides to domestic oil and gas to support the expansion of renewable energy.

People are calling for change and governments around the world have economic and political reasons to keep them on side. Mandating ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting is a cornerstone policy for demonstrating that they are responding to consumer concerns and positioning themselves as attractive locations for ethically-minded businesses.

A strong first step

The steps we have seen so far from individual governments are positive. The next step is to encourage coordination at an international level to ultimately achieve the harmonisation of global reporting standards. This will be the key to ensure government-mandated ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting does not create another wave of standards that add further complexity for large and small businesses alike.

ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More is here to stay and businesses need to take note. The ones that do will save themselves the time, effort and significant cost of playing catch-up when – not if – ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More becomes a regulated field. With all eyes on ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More, there has never been a better time for businesses to take the first steps in looking at their sustainability credentials with as much importance and rigour as their financial disclosures.

About the author:

Jessica is Head of Europe, and Chief Corporate Affairs Officer at Diginex. She has been driving the vision behind Diginex’s latest product with the purpose of democratising ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting. Currently, she leads strategic partnerships and framework integration, whilst keeping a pulse on the evolving sustainability reporting landscape.Jessica holds an Executive Master’s in Leadership from Wharton, Columbia, LBS and INSEAD, an MBA from IE Business School in Madrid and an MA from the Graduate Institute of International Relations in Geneva. She is passionate about helping organizations to strategically address socialSocial criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. More and sustainability risk and opportunities for sustainable value creation.

The post Guest Post: Government-Mandated ESG Standards – a Welcome Step Forward appeared first on ESG Today.