ICE Acquires Emissions Data and Analytics Provider Urgentem

Global exchange and clearing house operator Intercontinental Exchange (ICE) announced today the acquisition of carbon emission data and climate risk analytics provider Urgentem.

According to ICE, the acquisition will enable the expansion of its climate risk offering, adding extended coverage to over 30,000 global public and private companies across new geographies, along with scenario risk analysis and stress testing for fund managers and banks.

Elizabeth King, Chief Regulatory Officer and President of Sustainable Finance at ICE, said:

“With the increased focus on climate change and the transition to a carbon-neutral economy, the investment community requires more transparency into corporate emissions and climate risk. Urgentem’s broad database and sophisticated modelling analytics will quickly expand our offering, and together with ICE’s physical climate risk solutions, will provide a full suite of sustainable finance services.”

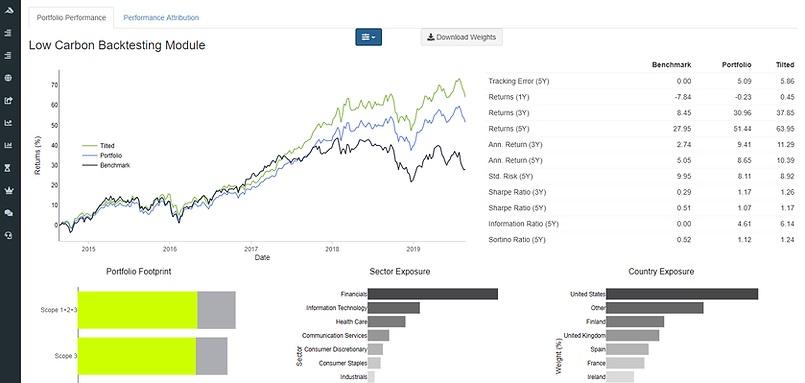

Urgentem provides Scope 1, 2 and 3 greenhouse gas (GHG) emissions data for entities across the major investable indices and sovereign bond universe, along with analytical tools, and investment services and products aimed at enabling financial sector participants to participate in the transition to a low carbon economy.

The companies said that their solutions can also help clients in their climate reporting needs by matching TCFD requirements, which underpin many of the major emerging sustainability reporting regimes in the EU, UK and US.

Urgentem’s Chief Executive Officer Girish Narula, said:

“As investors navigate the evolving landscape around corporate ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More reporting, data has been a lynchpin for helping benchmark where companies are today, and understanding their transition plans for the years ahead. We’re excited to join ICE’s team of product developers and data scientists to offer impactful ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More data for the financial community, and to provide services that can help manage climate risk and comply with global regulatory requirements.”

The post ICE Acquires Emissions Data and Analytics Provider Urgentem appeared first on ESG Today.