GRESB Launches SFDR Reporting Solution for Real Estate Managers

Real estate and infrastructure-focused ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More data provider GRESB announced the launch of its new SFDR Reporting Solution, aimed at helping real estate fund managers to report on product- and entity-level ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More practices.

The EU Sustainable Finance Disclosure Regulation (SFDR) establishes harmonized rules for financial market participants on transparency regarding the integration of sustainability risks and the consideration of adverse sustainability impacts in their processes and the provision of sustainability‐related information with respect to financial products.

In the upcoming phase of the regulation, set to come into effect in 2023, reporting obligations will include disclosures on the manner in which sustainability risks are integrated into investment decisions, and assessments of the likely impacts of sustainability risks on the returns of financial products, measurement and tracking of KPIs, principal adverse impacts (PAIs) and EU Taxonomy alignment.

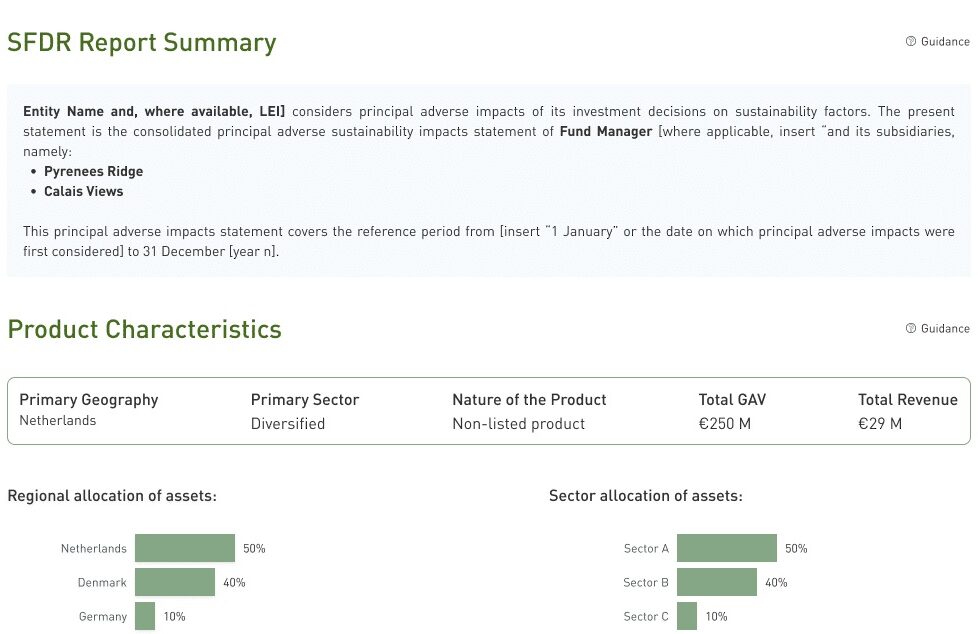

According to GRESB, the new solution aims to help managers with Article 8 (products promoting environmentalEnvironmental criteria consider how a company performs as a steward of nature. More or socialSocial criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. More characteristics) or Article 9 (products with a sustainable investment objective) to funds meet the most arduous part of the regulation. The solution provides an interactive report that features the information needed for a fund manager to finalize a PAI statement, highlighting the fund’s overall product characteristics and environmentalEnvironmental criteria consider how a company performs as a steward of nature. More impacts, as defined by SFDR, along with energy consumption, estimated GHG emissions, water usage and waste generation, as well as aggregated performance on each of the relevant PAI indicators.

Sebastien Roussotte, CEO of GRESB, said:

“Now, fund managers can tackle SFDR’s central data challenge and future-proof their year-over-year reporting from the start with better data. We created this solution to provide fund managers with the flexibility and the data they need to stay compliant at a very competitive price and time investment. And a significant portion of the SFDR reporting burden has been eliminated for entities that have already reported asset-level data through the 2022 GRESB Real Estate Assessment.”

GRESB stated that an SFDR Assessment for infrastructure funds will be available later in the year.

The post GRESB Launches SFDR Reporting Solution for Real Estate Managers appeared first on ESG Today.