Morningstar Launches Platform Enabling Investors to Identify Fund ESG Risk, Impact & Opportunities

Investment research firm Morningstar announced the launch of Investable World, a new digital platform aimed at making sustainable investing “more understandable, engaging, and actionable,” with tools allowing investors to explore key ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More themes including water, food, energy, health, and community, and to screen funds for ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risk, impact and opportunities.

According to Morningstar, the platform recognizes a wide set of investors’ motivations and preferences regarding ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More investing, ranging from risk avoidance to contribution to sustainable impact. “Investors have differing preferences around sustainable investing, but their interest in the topic is undeniably mainstream,” said Morningstar CEO Kunal Kapoor.

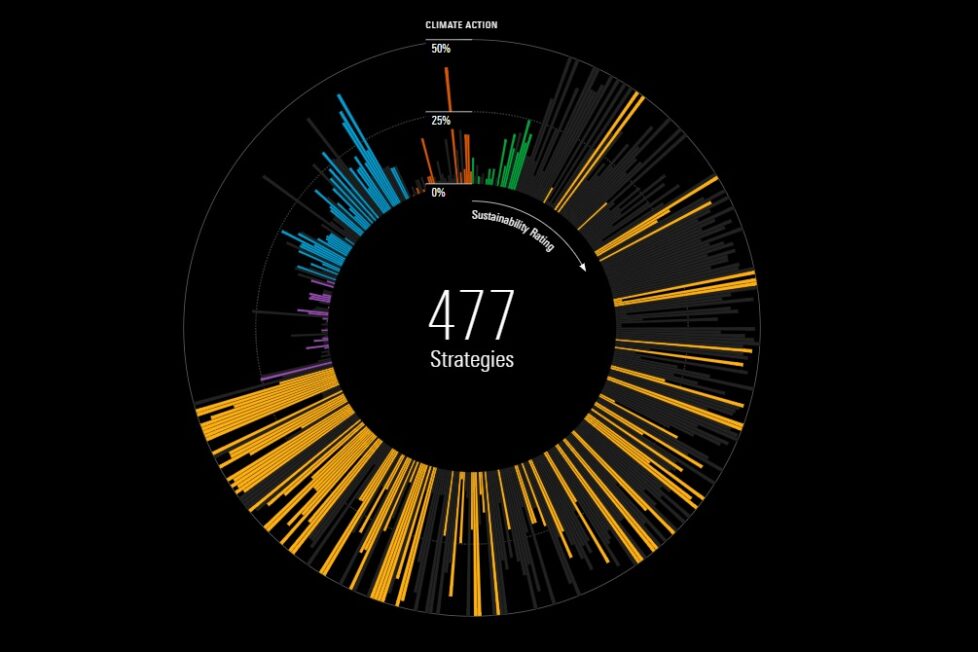

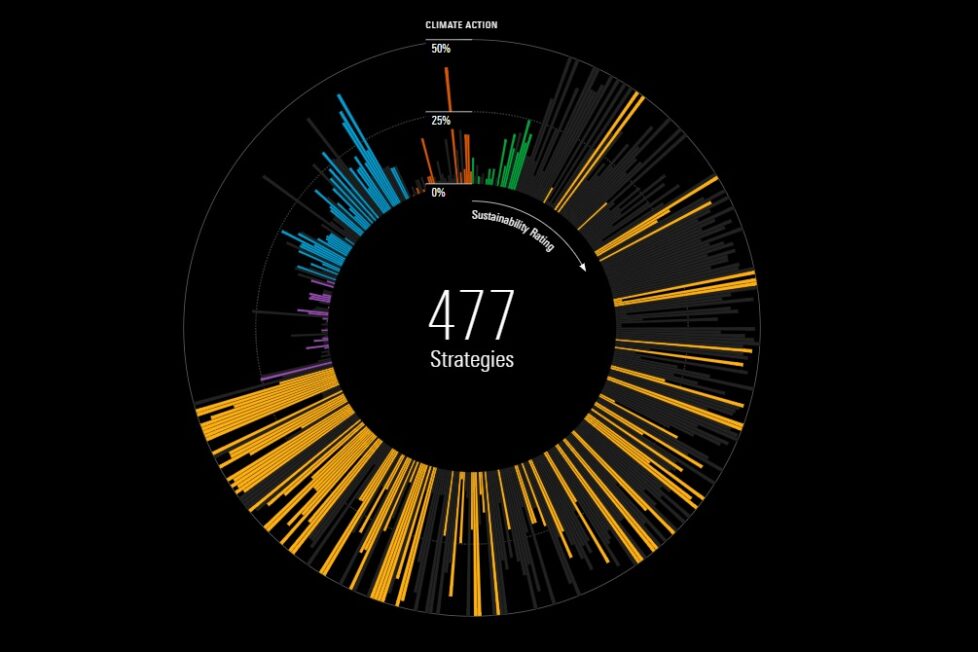

The platform includes a data visualization tool enabling users to filter 750 thematic funds globally according to these themes, and according to intention, such as investment, impact and exclusion. The tool allows investors to find funds that may contribute to their preferred themes, or avoid specific ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risks. Investable World also provides investors with access to research-driven investment education resources across each of the key themes.

Kapoor added:

“Today’s definition of what’s considered uniquely ‘investable’ for each person varies by the investor’s goals and conviction across three dimensions: performance, risk, and sustainable impact. Investable World brings transparency and accessibility to investors, empowering them to make choices that align with success on their own terms.”

The post Morningstar Launches Platform Enabling Investors to Identify Fund ESG Risk, Impact & Opportunities appeared first on ESG Today.