ESG Risk Management Software Provider Datamaran Raises $13 Million

ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risk management software company Datamaran announced the completion of a Series B funding round, raising £11.7 million (USD$13.3 million), with proceeds aimed at supporting product development and hiring.

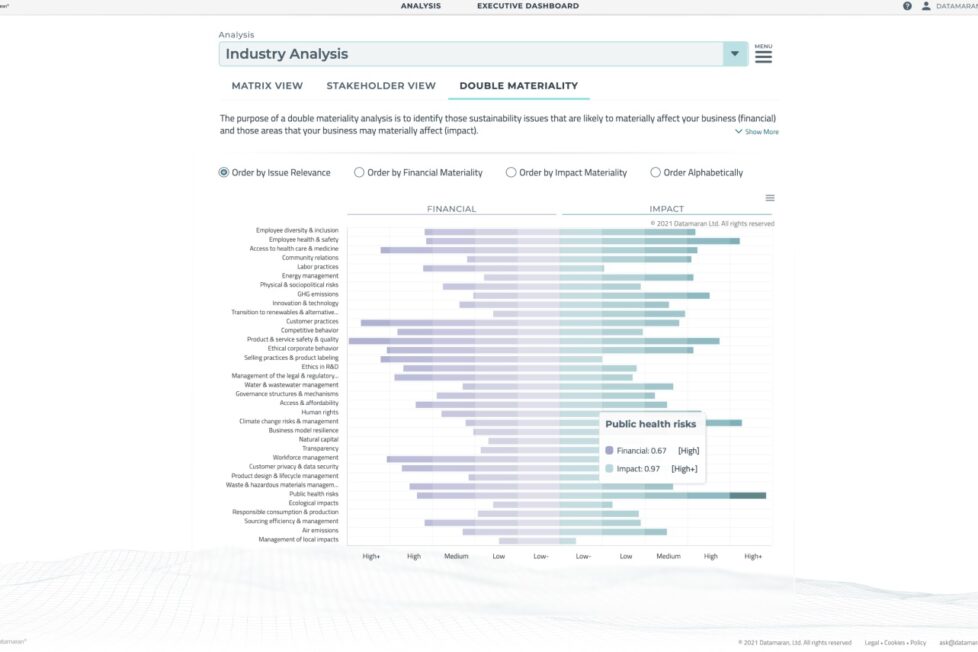

Datamaran’s software analytics platform identifies and monitors external risks, including ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More, offering real-time analytics on strategic, regulatory, and reputational risks, specific to users’ businesses and value chains. The company was recently selected by J.P. Morgan to power the double materiality framework of its new ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Discovery platform, providing materiality assessment models, which utilize data from corporate disclosure, regulatory, and media sources to anticipate emerging topics positioned to have a financial impact on markets. Additional companies using Datamaran include Dell, Walgreens, and PepsiCo.

Marjella Lecourt-Alma, CEO and Co-founder of Datamaran, said:

“After years of expansion, organic growth and achieving profitability, we see even more potential for the strategic insight we provide. This investment provides us with the capital necessary to match the growth opportunities that are increasing at an ever-faster pace as customers, employees and regulators double down on their ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More expectations.”

Datamaran said that it has seen a surge in interest from business leaders for its solutions. The company launched the Datamaran for Executives solution last year, aimed at automating external and ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risk management for corporate leaders, and revealed today that its C-suite audience now makes up over 40% of revenue.

Lecourt-Alma added:

“With this backing, Datamaran will accelerate the process of taking ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More to the C-suite and meet growing demand.”

The company stated that it will use the investment proceeds from the funding round to enable additional product innovation, and to support the expansion of its U.S. team.

The financing was led by Fortive, with participation by from American Electric Power, both of whom are also clients of Datamaran.

Justin McElhattan, VP & Group President of Fortive’s EnvironmentalEnvironmental criteria consider how a company performs as a steward of nature. More, Health & Safety Group, said:

“Datamaran’s unique technology ensures businesses have the actionable and quantifiable data they need to prepare for the rapidly changing expectations of society from corporations. Datamaran brings transformative results to businesses around the world – including Fortive – to accelerate progress for a more sustainable future.”

The post ESG Risk Management Software Provider Datamaran Raises $13 Million appeared first on ESG Today.