Shell Acquires Largest European RNG Producer Nature Energy for $2 Billion

Energy giant Shell announced today an agreement to acquire renewable natural gas (RNG) producer Nature Energy Biogas from a consortium of institutional investors, including Davidson Kempner Capital Management, Pioneer Point Partners and Sampension, for an enterprise value of nearly $2 billion.

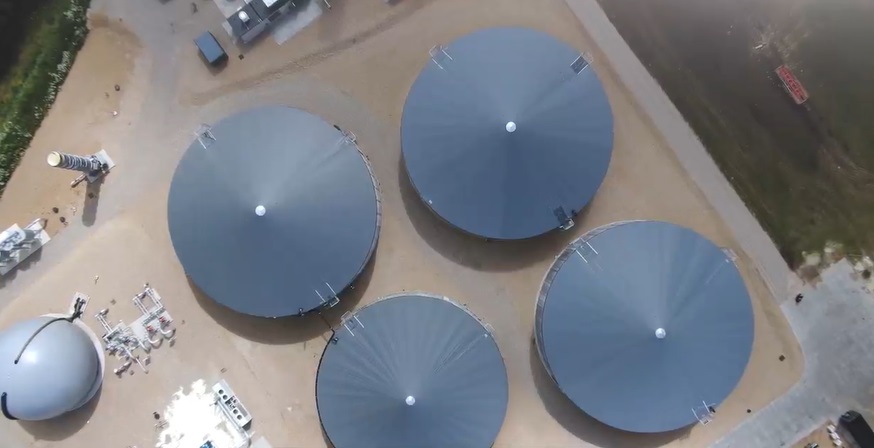

Founded as a natural gas distributor in 1979, Denmark-based Nature Energy established its first biogas plant in 2015. The company is the now largest RNG producer in Europe, according to Shell, operating 14 industrial scale biomethane plants, with current annual production of around 6.5 million MMBtu, and with a development pipeline of about 30 plants across Europe and North America.

RNG, or biomethane, is produced from organic waste, such as agricultural, industrial, and household wastes, and is chemically identical to fossil-based natural gas, enabling it to support the decarbonization of hard-to-abate sectors such as road transport and heavy industry, without needing to replace existing transmission and distribution infrastructure.

According to Shell, the deal fits its Powering Progress strategy. Launched last year, the strategy details how it will achieve its target to be a net-zero energy business by 2050 across Scope 1, 2 and 3 emissions, and invest in renewable and clean energy solutions. The company recently announced a relocation of its headquarters to the UK from the Hague as part of an initiative to help speed up the delivery of its strategy to become a net zero emissions business.

In addition to its RNG assets and pipeline, Shell stated that the acquisition will also provide it with in-house expertise in the design, construction, and operation of innovative and differentiated RNG plant technology.

Huibert Vigeveno, Shell’s Downstream Director, said:

“Acquiring Nature Energy will add a European production platform and growth pipeline to Shell’s existing RNG projects in the United States. We will use this acquisition to build an integrated RNG value chain at global scale, at a time when energy transition policies and customer preferences are signalling strong growth in demand in the years ahead.”

The deal marks the second large-scale RNG transaction by an energy major in recent weeks, following bp’s $4 billion acquisition of U.S.-based RNG provider Archaea Energy.

The post Shell Acquires Largest European RNG Producer Nature Energy for $2 Billion appeared first on ESG Today.