Sustainalytics Launches ESG Risk Ratings for Fixed Income and Private Equity

ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More ratings, data, and research provider Morningstar Sustainalytics announced today an expansion to its ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Risk Ratings service to new asset classes including fixed income and private equity, as well as the addition of listed Chinese.

According to the company, the announcement marks a nearly 30% increase in coverage to more than 16,300 analyst-based ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Risk Ratings.

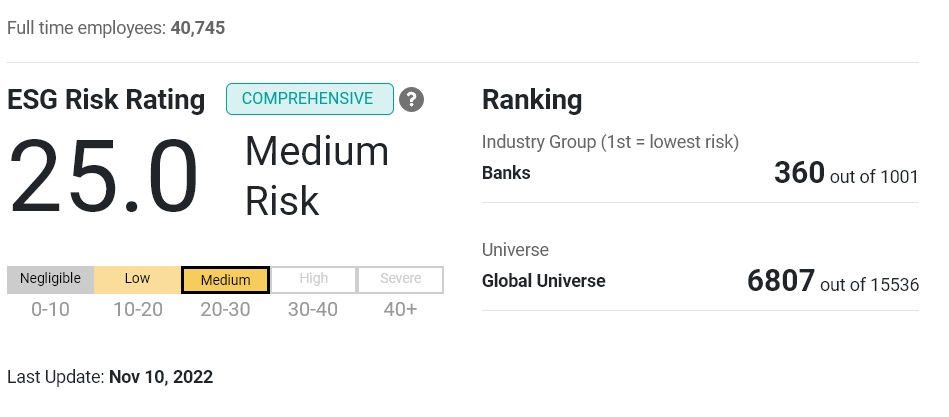

Sustainalytics’ ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Risk Ratings are designed to measure a company’s exposure to industry-specific material ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risks, and how well it is managing those risks. The provider’s research and ratings center on corporate governanceGovernance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. More, material ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More issues and idiosyncratic issues, and its ratings framework is supported by 20 material ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More issues that are underpinned by more than 300 indicators and 1,300 data points.

The company said that the new coverage is being added amidst increasing sustainable fund inflows in fixed income, stronger emerging markets ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risk management and growing sustainability opportunities in private equity markets, while investors face challenges in availability of consistent ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More data in assets classes other than public equity.

Laura Lutton, Director of ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Research and Risk products at Morningstar Sustainalytics, said:

“Sustainalytics’ recent coverage expansion provides investors more human insights supporting the consistent data and research needed to effectively measure financially material ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More risk. The ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Risk Ratings harness the power of our global research analysts’ knowledge and capabilities when it comes to the nuances of ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More assessment.”

The post Sustainalytics Launches ESG Risk Ratings for Fixed Income and Private Equity appeared first on ESG Today.