Preqin Launches New Benchmarks to Assess Private Markets ESG Funds

Alternative investment data and insights provider Preqin announced today the launch of new ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More performance benchmarks aimed at enabling users to assess performance of private markets ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More funds, as well as SFDR, impact and climate funds.

According to Preqin, the new benchmarks address the lack of standardized and comparable ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More fund performance data, which has contributed to an increase in anti-ESG sentiment and criticism in recent years, with the new tools enabling investors, fund managers and advisors to make informed decisions when it comes to ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More and impact investing in the “famously opaque” alternative markets.

Jaclyn Bouchard, EVP, Head of ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More Solutions & Corporate Responsibility at Preqin, said:

“At Preqin, we look to empower anyone who invests in, allocates to or advises on ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More in Alternatives. Through our benchmark offering, we aim to unleash the power of data to increase transparency around the performance of ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More funds to enable more opportunities for capital to flow to sustainable investments”.

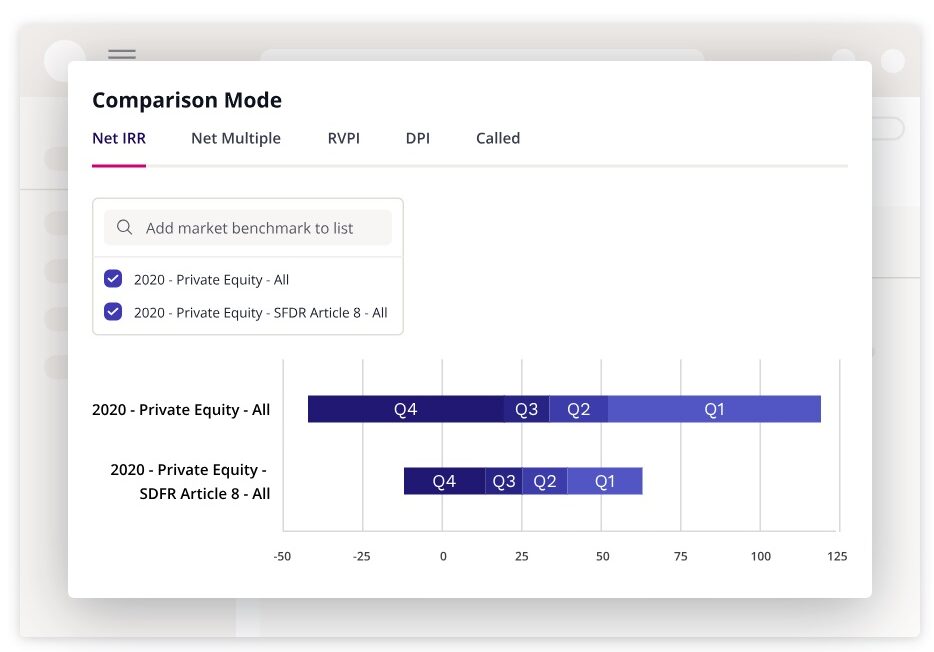

Preqin’s ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More benchmarks cover ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More integration, Impact, Climate, SFDR Article 8, SFDR Article 9, Sustainable Development Goals (SDG) and Sharia Compliant, and provide information into over 200 ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More fund performance benchmarks, covering more than 1,000 ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More funds, including SFDR funds, and encompassing ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More fund labels across the main private market asset classes, including private equity, venture capital, real estate, private debt, natural resources and infrastructure.

Fabien Chen, SVP, Head of Benchmarks, at Preqin, said:

“With this latest launch, we hope to give practitioners another tool to help them to understand whether ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More funds outperform the market or their non-ESG peers. As we expand and innovate on our benchmark offerings, we will bring further transparency and objectivity to enhance decision making and accountability in the private markets”.