Guest Post: Understanding the SEC’s Proposal on Mandatory Disclosures- Part II

“A problem well stated is half solved,” Charles Kettering. But unfortunately, when it comes to climate change, we are better at perfecting the problem than focusing on the solution –platitudes don’t cost a dime, while fixing the problem is messy and expensive.

Part I of my article addresses the need to embrace the climate crisis we have created; corporations and investors need to take the necessary steps towards a low carbon future. Investors’ skepticism towards the corporation’s bold climate-related commitments urged the SEC to propose stringent climate-related disclosures integrated into the corporation’s financial statements.

The SEC’s nearly 500 pages of the proposal on mandatory disclosures have nothing to do with EnvironmentalEnvironmental criteria consider how a company performs as a steward of nature. More and SocialSocial criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. More GovernanceGovernance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. More (ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More). Instead, it has everything to do with climate-related risks and opportunities and how to efficiently disclose them in the financial statements.

The SEC’s proposed rule, if passed, would require public companies (registrants) to divulge climate-related risks and opportunities that are reasonably likely to have a material impact on the registrant’s business, results of operations, or financial condition. The disclosure would also include the registrant’s greenhouse gas emissions (GHG – Scopes 1, 2, and 3). So, what is the big deal?

Under the SEC’s proposed rules, specific climate-related financial metrics would be required in a registrant’s audited financial statements.

This article intends to address why the SEC’s mandatory disclosure is a critical first step in moving away from platitudes and addressing the actual issue. Will the proposal get passed in the United States? As I address the latter half of the SEC’s proposal -which primarily focuses on weaving the climate-related disclosures into the audited financial metrics of the publicly traded companies in the United States, it is important to note – transition to a low-carbon economy is feasible; however, it requires consistent, transparent measures by the corporations, investors and the consumers.

“There is no greater mistake than to suppose that platitudes, smooth words, timid policies, offer today a path to safety.”-Winston Churchill

According to the New York Times article “What’s really behind corporate promises on climate change?”, many businesses have not set targets for reducing Greenhouse Gas Emissions (GHG).[1] As companies layout boisterous plans for climate change, crucial details were often missing from that pledge. For instance, Larry Fink, BlackRock’s chief executive, wrote that the coronavirus pandemic had “driven us to confront the global threat of climate change more forcefully,” and the company said it wants businesses it invests in to remove as much carbon dioxide from the environment as they emit by 2050 at the latest. However, necessary details as to what proportion of the companies BlackRock invests in will be zero-emission businesses in 2050 were not clear.

Similarly, household names like Costco and Netflix have not provided emissions reduction targets despite saying they want to reduce their impact on climate change. Like the agricultural giant Cargill and the clothing company Levi Strauss, others have made commitments but have struggled to cut emissions. Technology companies like Google and Microsoft, which run power-hungry data centers, have slashed emissions. Still, even they find that the technology often doesn’t yet exist to carry out their “moonshot” objectives.[2]

Actions must follow corporate platitudes that push the transition to a low carbon economy. The SEC’s enhancement of mandatory disclosures is intended to force corporations to measure and estimate the cost involved in the transition to a low carbon economy.

In a nutshell, the 500 pages of SEC’s enhancement of mandatory disclosers focus on

Accountability by corporations on climate-related risks and opportunitiesFinancial impact metrics disclosure would require the registrant to provide how identified climate-related risks have affected or reasonably affected the registrant’s consolidated financial statements (factoring estimated expenses during the transition period).Registrant must disclose all negative impacts on an aggregated line-by-line basis and separately, on an aggregated, line-by-line, all positive impacts during the transition based on a pre-determined disclosure threshold.[3] A positive and negative aggregate disclosure will impact a registrant’s financial statements – income statement, cash flow statement, and balance sheet.The registrant is expected to disclose its GHG emissions (direct and indirect) for its most recently completed financial year. GHG emissions data can be instrumental in conducting a transition risk analysis. Therefore, the GHG emissions disclosure must follow the GHG protocol – a leading accounting and reporting standard for GHG emissions. The disclosure targets the Scope 1, Scope 2, and Scope 3 emissions.[4]

Since the SEC’s proposal, thus far, 19 Republican U.S Senators, the U.S Chamber of Commerce, 17 trade associations, and industry organizations have sent a series of letters to the SEC requesting a further extension for comment deadlines. In some cases, Senators sent letters of opposition against the SEC’s proposal.[5]

The SEC’s proposal on mandatory climate-related disclosures, if passed, will redefine the way manner in which registrants conduct business and view profits.

A U.S. Securities and Exchange Commission proposal to require companies to disclose information about greenhouse gas emissions may not go far enough for some progressives and go too far for many on the right, according to policy analysts.[6]

Without immediate and deep emissions reductions across all sectors, limiting global warming to 1.5°C is beyond reach. Limiting global warming will require significant transitions in the energy sector. This will involve a substantial reduction in fossil fuel use, widespread electrification, improved energy efficiency, and the use of alternative fuels. We are not there yet. Presently, corporate commitments are vague and filled with hollow platitudes.

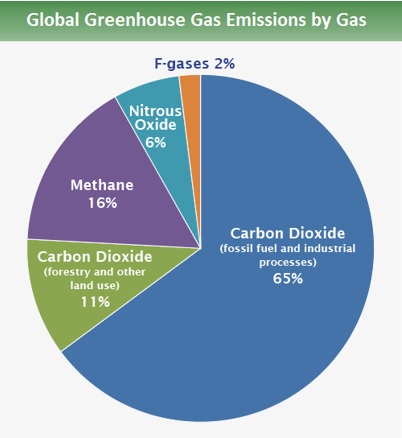

According to the EnvironmentalEnvironmental criteria consider how a company performs as a steward of nature. More Protection Agency (EPA), on a global scale, the key greenhouse gases emitted by human activities are condensed below[7]:

The critical area to focus on in the SEC’s proposal is the GHG emissions disclosure requirement and how Scopes 1, 2, and most importantly, Scope 3 can be quantified and disclosed consistently. In addition, GHG emissions disclosure can be particularly useful in conducting a transition risk analysis.

The proposed GHG rules would establish requirements such as[8]:

Measurement and reporting of GHG emissions would promote comparability.GHG emissions include direct and indirect emissions.Scope 1, Scope 2, and Scope 3 emissions are clearly defined.The proposal would require a registrant to disclose its total Scope 1 emissions separately from Scope 2 emissions.The proposal would require the registrant to disclose its total Scope 3 emissions for the fiscal year, if those emissions are material, or if it has set a GHG emissions reduction target or goal that includes Scope 3 emissions.The proposal would require a registrant to disclose the emissions disaggregated by each constituent GHGand in the aggregate for each Scope.The proposal would require the registrant to disclose GHG emissions data in gross terms for all Scopes, excluding any use of purchased or generated offsets.

The SEC’s proposal acknowledges that the data for Scope 3 emissions is harder to source than Scope 1 and Scope 2. Therefore, SEC is not proposing to adopt all the features of the GHG protocol; however, it uses the methodology that better suits the U.S financial reporting regime and the needs of the investors.

The challenge in embracing the SEC’s proposal for Scope 1, Scope 2, and Scope 3 is the availability of reliable data. Presently, EPA provides detailed methodologies for a range of industries with significant Scope 1 emissions. The proposal acknowledges the challenges in upstream and downstream aspects of emissions in Scope 3; however, for instance, SEC expects the registrants to work with their suppliers to reduce the emissions. In a nutshell, SEC proposes several strategies that a registrant could follow in reducing its Scope 3 emissions.[9]

If passed, the SEC’s proposal demands registrants to measure and capture extremely complex Scope 3 data and estimate the transition costs in the registrant’s financial system. The proposal forces an undue burden on the registrant.

Scope 3 emissions have proven much more difficult for companies to account for than Scopes 1 or 2, both of which are under their direct control. The lack of standardized methodology and the need to rely on modeling have led to limited and cautious integration of Scope 3 data into investment processes; however, not reliable.

The SEC acknowledges these difficulties and proposed a transition period for the registrants to weave the disclosure into its financial statements. However, there are substantial limitations to Scope 3 data reliability, such as breadth and accuracy of company reporting, comparability, and double counting issues for “portfolio footprinting.” For example, even if the number of public companies reporting Scope 3 emissions in 2021 grew 30% from 2020, more than 40% of companies reporting Scopes 1 and 2 are still not reporting Scope 3 – a trend that has remained unchanged for the last three years.[10]

A path to net-zero is paved with vague and hollow corporate commitments.

On April 14, 17 trade associations and industry organizations in the real estate, lodging, finance, and securities industries jointly submitted a request for the SEC to extend the comment period by an additional 30 days. Despite the opposition, the SEC may be strongly motivated to finalize the rules before year-end 2022. By finalizing the rules before year-end, disclosures regarding 2023 data can be required of registrants in their 2024 filings. The SEC may also be motivated to conclude the rulemaking process before the mid-term elections in November.

Since the launch of the SEC’s proposal of mandatory disclosures, lobbying groups and politicians in the United States have already objected to the proposal. The proposal will force companies to be private instead of publicly traded. While few senators voiced their concern over SEC’s proposal, the top Republican on the Senate Banking Committee and many Republican lawmakers have voiced opposition to the growing focus on climate-related issues among several federal financial regulators, including the SEC, Federal Reserve, and Treasury Department. Here are some comments from the United States Senators.

“The proposed rule comes against high inflation, skyrocketing energy prices, and immense efforts to cut off Russian energy supplies. Whether it is putting forth radical nominees to important financial regulatory positions or proposing burdensome regulations like the proposed rule on climate-related disclosure, this administration’s hostility towards fossil fuels has serious consequences throughout the entire economic value chain and our domestic energy resources and national security.”[11]

“I am deeply concerned that the proposed rule has the potential to run counter to the SEC’s long-standing commitment to its mission by adding undue burdens on companies while simultaneously sending a signal of opposition to the all-of-the-above energy policy that is critical to our country right now.” – U.S Senator

As the shift towards low carbon development pathways becomes an even stronger imperative, Scope 3 emissions can no longer be ignored. The largest pension fund globally, Japan’s Government Pension Investment Fund (GPIF), has identified a “shockingly large gap” between its reported carbon emissions over the past two years after including its Scope 3 emissions in its latest analysis. The Carbon Disclosure Project (CDP) found that value chain emissions are, on average, 11.4 times higher than operational emissions.[12]

From a macroeconomic point of view, the integration of Scope 3 also allows for better monitoring of pathways to decarbonization. Imported goods will be consumed locally but have generated GHG emissions in other countries for their production. Exported goods have generated emissions locally but will be consumed in other countries. The practical applicability and a path towards net-zero require pragmatic steps towards a unified solution.

The climate-change initiative is presently all rhetoric. Investors, corporations, and consumers must work together beyond politics to make a net-zero ambition a reality.

Regardless, the SEC appears steadfast in enforcing the proposal by 2022.

About the author:

Laks Ganapathi is a researcher in clean energy – focusing on climate change, sustainability, EVs, and ESGEnvironmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. More. Laks is also the Founder and CEO of Unicus Research. Unicus is a long/short investment research firm dedicated to asset managers, wealth managers, and investors. A key differentiator for Unicus is that they strive to be the voice of reason to the investment community in the ocean of disinformation. They are here to gain their investors’ trust.

[1] https://www.nytimes.com/2021/02/22/business/energy-environment/corporations-climate-change.html

[2] https://www.nytimes.com/2021/02/22/business/energy-environment/corporations-climate-change.html

[3] SEC proposal page(s) 121-124 for a detailed financial impact.

[4] SEC proposal page 149

[5] See the letters from the U.S Senators – opposition and extension for comments deadline.

[6] https://news.bloombergtax.com/financial-accounting/sec-emissions-plan-to-face-push-back-on-both-sides-say-analysts

[7] https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data

[8] SEC’s proposal page:148

[9] Please review page 162-173 to understand what SEC’s proposal deems as Scope 3 and suggestions on how registrants could reduce the Scope 3 emissions. The proposal clarifies the upstream and downstream aspects of Scope 3 emissions.

[10] Clarity AI research based on CDP data

[11] https://www.sec.gov/comments/s7-10-22/s71022-20122544-278541.pdf

[12] https://clarity.ai/research-and-insights/why-scope-3-emissions-data-has-become-essential/

The post Guest Post: Understanding the SEC’s Proposal on Mandatory Disclosures- Part II appeared first on ESG Today.