Carbon Credit Ratings Provider Sylvera Launches Tools to Find, Compare and Screen Carbon Markets Projects

Carbon credit ratings provider Sylvera announced the launch of new tools on its platform for carbon markets investors, including a new product enabling users to discover and compare carbon reduction projects, and a solution to help screen and assess projects.

As demand for carbon offset projects and related credits is expected to increase significantly over the next several years, with companies and businesses increasingly pursuing net zero ambitions and turning to offsets as a bridge to their own absolute emissions reduction efforts, or to balance difficult to avoid emissions.

In a further potential boost to the carbon credit market, the SBTi recently announced that carbon credits will likely be permitted in net zero targets to help address Scope 3 emissions.

The unregulated and rapidly growing market faces a series of challenges, however, with market participants unable to differentiate between high and low quality projects with insufficient or inconsistent data to assess the effectiveness of the projects. Additionally, projects are currently fragmented across different registries, creating challenges for investors to find and compare projects.

Founded in the UK in 2020, Sylvera’s carbon intelligence platform helps organizations evaluate and invest in high quality carbon credits, utilizing proprietary data and machine learning technology to produce comprehensive insights on carbon projects. The company announced a $57 million funding round last year, with proceeds to be used to support its expansion, including the build out of its platform to include new data and information about carbon credits.

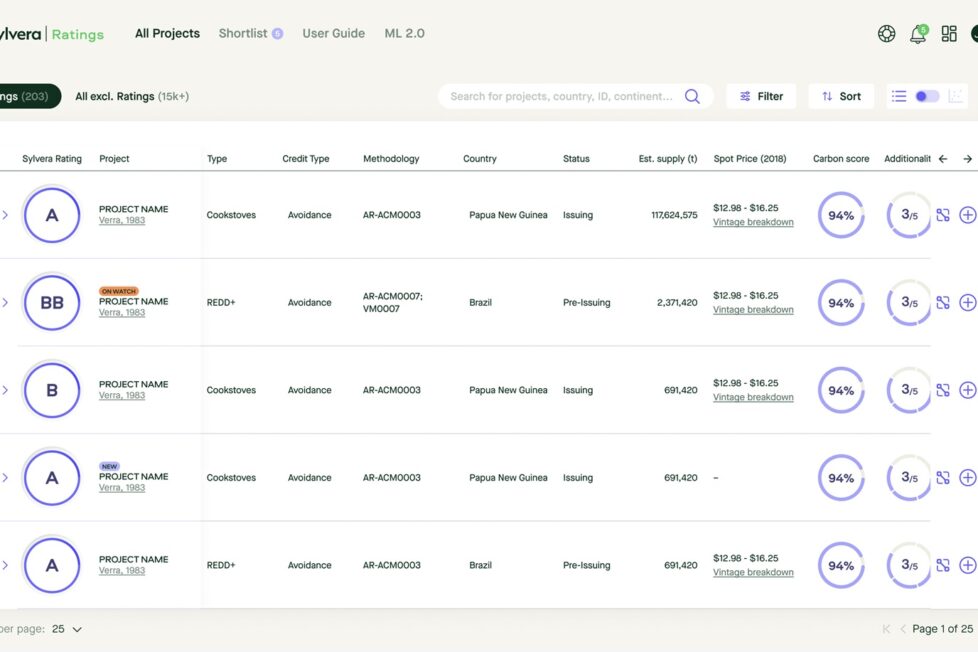

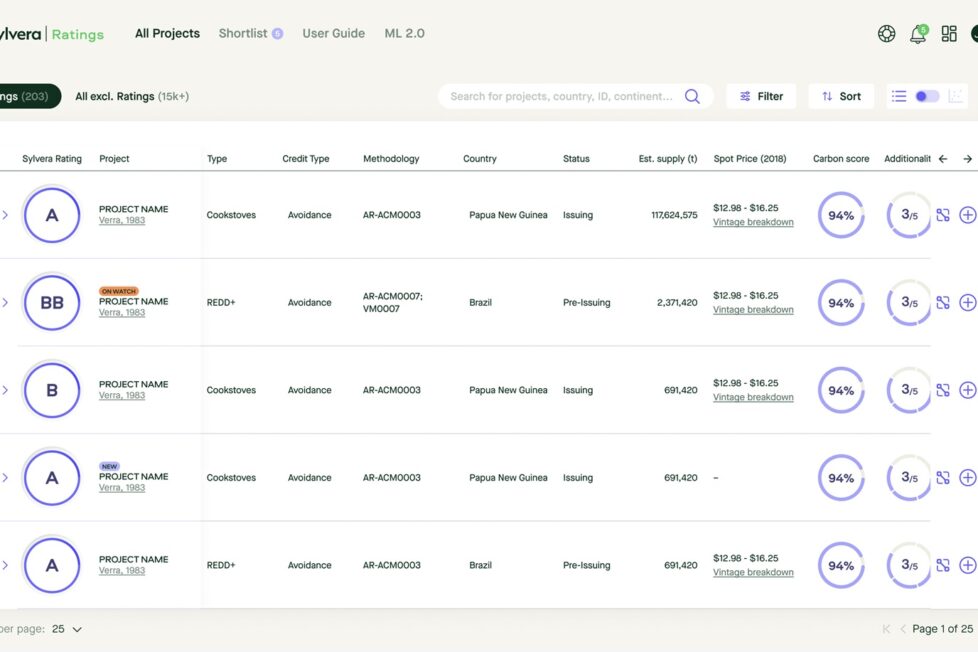

The new products include Sylvera Project Catalog, which brings together and harmonizes data from nine major registries, enabling investors to discover nearly 20,000 projects across technologies ranging from Biochar to Landfill Methane, as well as to compare across project types, and connect to suppliers to procure or invest in credits in a single place. The data sets are updated daily and Sylvera said that it plans to continue to add projects from more registries.

Sylvera also introduced Screenings, a new tool aimed at providing investors with an overview of project quality, key characteristic, and risk factors, with high-level assessments of key positives and risks across the quality pillars including carbon accounting, additionality, permanence and co-benefits. According to Sylvera, the new tool is designed to provide key signals of quality and risk early, allowing projects to be screened prior to conducting more detailed due diligence.

Allister Furey, CEO and co-founder of Sylvera said:

“Navigating the carbon market isn’t easy: it’s disjointed, opaque and ever-changing – that makes it hard for investors to find, understand, and invest in quality projects that advance their goals, as well as overall net zero progress. To incentivize investment in real climate action, we build the data and tools to reduce the barriers and streamline the process.”